Green Bonds: What Are They?

)

In the fluid landscape of modern finance, innovative investment vehicles continually emerge, promising to shape and reshape the sector. Among these, one star has been steadily gaining momentum: green bonds. Embodying a unique fusion of eco-consciousness and financial prudence, green bonds promise to yield profits and paint a greener future. In this guide, we will answer the question: “Green bonds: what are they?”, “What are the types of green bonds?”, “Why and how to invest in them?”, and much more.

Table of Contents

What Are Green Bonds?

Understanding Green Bonds

Types of Green Bonds

Green Bond Principles

How to Buy Green Bonds

Example of Green Bonds

Why invest in green bonds

How are green bonds different from blue bonds?

How are green bonds different from climate bonds?

How do I know if a green bond is actually green?

Green Bonds’ Timeline

Benefits and Risks of Green Papers

How big is the green bond market?

The Bottom Line: Key Takeaways

FAQ

What Are Green Bonds?

Let’s start with the main question “Green papers: what does it mean?” Green bonds, also known as green papers, are a type of bond or debt instrument that investors buy from the issuer. The unique thing about these bonds is their eco-friendly focus. The funds raised from selling these bonds are used exclusively for projects that benefit the environment, like renewable energy or clean transport initiatives.

They're a win-win financial product. Investors get their return on investment, while the planet gets a helping hand, making these bonds not just financially rewarding, but ethically appealing too.

Understanding Green Bonds

Green bonds are financial instruments where an investor lends money to the bond issuer in return for periodic interest payments and the return of the principal amount at the bond's maturity date. As mentioned above, the unique aspect of green bonds, setting them apart from conventional bonds, is that the raised funds are earmarked for environment-friendly projects, such as

-

renewable energy ventures like solar or wind power facilities;

- structures optimized for energy efficiency;

- modes of transportation with minimal emissions;

- responsible water management schemes;

- projects to preserve diverse ecosystems, etc.

Essentially, any project geared towards mitigating the effects of climate change or adapting to its repercussions could potentially be financed by green bonds.

Types of Green Bonds

There are several types of green bonds available on the market today. These include:

1. Green Use of Proceeds Bond

This is the most straightforward type of green bond. The proceeds are exclusively applied to finance or re-finance green projects. To assure investors, these bonds are often backed by the issuer's entire balance sheet.

2. Green Use of Proceeds Revenue Bond

The revenue generated from the green projects financed by these bonds are used to repay investors. This means that the credit risk associated with these bonds depends on the success of the projects themselves.

3. Green Project Bond

In this case, the bond proceeds are directly tied to a specific green project. The bondholders have a direct claim to the project's assets.

4. Green Securitized Bond

This type of bond is connected to a group of green projects or assets. The repayment to investors is sourced from the cash flows generated by these assets or projects. These can include green mortgages or loans.

Here's a simplified comparison table to understand the different types of green bonds:

| Type of Green Bond | Funds Use | Repayment Source | Debt Recourse | Examples |

| Green Use of Proceeds Bond | Green projects |

Issuer's entire balance sheet | Recourse to the issuer | IFC Green Bond, EIB Green Bond |

| Green Use of Proceeds Revenue Bond | Green projects |

Revenue from financed projects | Non-recourse, project revenues | MTA Green Bonds |

| Green Use of Proceeds Revenue Bond | Green projects |

Revenue from financed projects | Non-recourse, project revenues | MTA Green Bonds |

| Green Project Bond | Specific green project |

Specific green project's assets | Limited recourse, project assets | Invenergy Wind Farm |

| Green Securitized Bond | Group of green projects or assets |

Cash flows from the projects or assets | Non-recourse, securitized assets | Toyota Auto Loan Green Bond |

Green Bond Principles

In 2014, the International Capital Market Association (ICMA) introduced the Green Bond Principles (GBP), serving as voluntary directives designed to bolster transparency, enhance disclosure, and foster ethical conduct within the green bond marketplace. The GBP are comprised of four main elements:

-

Use of Proceeds. The capital raised from a bond must be channeled towards eco-friendly initiatives that deliver tangible environmental improvements.

- Process for Project Evaluation and Selection. The bond issuer needs to provide a detailed explanation of the environmental sustainability goals, the process employed to ascertain how the initiatives align with the accepted Green Projects classifications, and the relevant eligibility standards.

- Management of Proceeds. The net earnings from the Green Bond, or a sum equating to these net earnings, should be assigned to a subsidiary account, transferred to a separate portfolio, or in some way monitored by the bond issuer.

- Reporting. Green bond issuers should produce and maintain readily accessible, current data on the use of funds, which should be refreshed annually until the funds are fully allocated.

How green bonds work

The mechanics of green bonds are similar to those of traditional bonds. When you purchase a green bond, you are lending money to the issuer for a set period. The issuer, in turn, pays you periodic interest. At the end of the bond's term, also known as the maturity date, the issuer repays the principal amount.

However, green bonds are underpinned by a commitment to transparency and impact. Issuers are expected to disclose how the funds will be used, and often provide updates on the environmental benefits resulting from the funded projects. This accountability is typically ensured by third-party verifiers, offering investors peace of mind that their funds are truly driving positive environmental change.

How to Buy Green Bonds

)

If you are interested in getting involved in the green bond market, there are a few routes:

-

Direct purchase. Some green bonds can be bought directly from the issuer or through a broker.

- Green bond funds. Many asset management firms now offer funds that invest in a diversified portfolio of green bonds. This route provides easier access for smaller investors and can spread out the risk associated with investing in a single bond.

- Stock exchanges. Green bonds are also traded on stock exchanges, such as the Luxembourg Green Exchange and the London Stock Exchange's dedicated green bond segment.

Example of Green Bonds

A quintessential example of green bonds in action involves the World Bank, a significant green bond issuer. From 2008 through 2020, the World Bank issued $14.4 billion worth of green bonds. These bonds funded 111 environmental projects across the globe, with the majority of the funds allocated to renewable energy and efficiency (33%), clean transportation (27%), and sustainable agriculture and land use (15%).

One landmark project was the Rampur Hydropower Project in Northern India, financed through these green bond issuances. This initiative significantly contributes to the production of low-carbon hydroelectric power, generating nearly 2 megawatts annually, which translates to preventing approximately 1.4 million tons of carbon emissions, vividly demonstrating the real-world impacts of green bonds.

Why Invest in Green Bonds?

Investing in green bonds is an excellent way for investors to align their financial portfolios with their personal values, particularly if they are focused on environmental sustainability. This form of sustainable bond provides a practical avenue for participating in climate change mitigation, as the proceeds are dedicated to funding green projects like renewable energy and energy efficiency.

Moreover, green bonds also provide attractive financial incentives. Issuers of green bonds may enjoy tax exemptions, while investors could benefit from tax credits, meaning the interest earned on these investments might not be subject to income tax. Hence, investing in green bonds not only contributes to environmental welfare but also offers compelling financial benefits, making them a significant part of any climate-aware investment strategy.

Green Bonds vs. Blue Bonds

Green bonds and blue bonds, both subsets of sustainability bonds, have different focuses when it comes to financing environmental projects. Green bonds, a rapidly growing segment in capital markets, are instruments issued by financial institutions and governments to fund sustainable projects that directly contribute to environmental improvements, such as renewable energy, energy efficiency, and climate change mitigation efforts. On the other hand, blue bonds are a specific type of green bond that concentrate on protecting ocean and marine ecosystems. They fund initiatives like sustainable fisheries, coral reef protection, and pollution reduction.

Green Bonds vs. Climate Bonds

Green bonds and climate bonds, while often used interchangeably, have distinct scopes. Green bonds support various environmental projects, like renewable energy and sustainable development. Climate bonds, on the other hand, are narrowly focused on reducing carbon emissions and combating climate change impacts.

How do I know if a green bond is actually green?

Green papers: what is this? Identifying the genuine "green" status of a bond can be a complex process, as there is currently no universally accepted standard to assess a bond's environmental friendliness. Despite the efforts of organizations like the Climate Bonds Initiative, the lack of a unified benchmark can lead to instances of “greenwashing.” This term refers to instances where bonds are marketed as "green" but their positive environmental impact is, at best, questionable.

So, how does an investor determine if a green bond is truly green? The answer lies in thorough due diligence. Investors need to examine very carefully the claims made by bond issuers about their environmental impact. This can involve evaluating the bond's alignment with green bond principles, scrutinizing how green bond proceeds are used, and understanding the nature of the environmental projects the bonds aim to finance.

Green Bonds Timeline

Green bonds started modestly in 2012, with only $2.6 billion worth of issuance. However, the market witnessed a significant transformation around 2016 when China, accounting for more than a third of all issuances, catalyzed their popularity.

By 2017, the global reach of green bonds had skyrocketed, setting a record with $161 billion in investments, as reported by Moody's. After a slight lull in 2018, the demand resurged due to heightened climate awareness, bringing the total green bond issuance to a staggering $266.5 billion in 2019 and almost $270 billion in 2020.

The past decade also marked the advent of green bond funds, significantly broadening the potential for retail investors to invest in green projects. Renowned investment companies and asset management firms, including Allianz S.E., Axa S.A., State Street Corp., TIAA-CREF, BlackRock, AXA World Funds, and HSBC, have sponsored green bond mutual funds or ETFs, further cementing the bonds’ role in the market.

Benefits and Risks of Green Papers

Advantages

-

Access to a diversified pool of investors. Issuing green bonds allows corporations and financial institutions to reach a wider, sustainability-focused investor base.

- Positive corporate image. A commitment to environmental responsibility, demonstrated by issuing green bonds, boosts the public image and reputational capital of the issuing entity.

- Alignment with global sustainability goals. Green bonds enable issuers to participate in the global fight against climate change, supporting projects aimed at reducing greenhouse gas emissions and fostering sustainable development.

- Potential regulatory benefits. Given the increasing global emphasis on sustainability, issuers might also benefit from regulatory incentives that favor green initiatives.

Disadvantages

-

Higher disclosure and reporting requirements. Green bond issuers are bound by the Green Bond Principles, which necessitate transparency and stringent reporting about the environmental impact of funded projects.

- Risk of greenwashing. If issuers fail to align the use of green bond proceeds with the declared environmental projects, they may face criticism and loss of investor trust.

- Cost. The process of issuing green bonds can be more costly due to the need for third-party validation, increased reporting, and the implementation of the green projects themselves.

Nonetheless, for many issuers, the advantages of tapping into the growing green bond market, fostering environmental projects, and gaining investor goodwill often outweigh the challenges. The positioning of investors towards green bonds is increasingly positive, as these instruments align financial return with environmental responsibility.

Investor positioning for green bonds

Green bonds serve to fund renewable energy initiatives, energy efficiency measures, and other sustainable projects, and are attractive to institutional investors who are conscious of their ecological footprint.

Today's investors are no longer satisfied with the mere traditional risk-return trade-off; they are closely examining the actual environmental impact of bond issuers. This implies a significant shift in investor positioning for green bonds. An investment in green bonds is no longer perceived solely as a financial instrument; it has become a meaningful vote for the company's environmental performance and credibility.

Is the green bond market big?

The green bond market is rapidly growing. This was once a small area within the capital markets, but is now a key player helping to address climate change and promote sustainable development. Governments, businesses, and financial institutions around the world are using green bonds to fund environmentally friendly projects like renewable energy and energy efficiency initiatives.

Investors are also showing more interest in these bonds. They offer a financial return and give investors a way to help the environment. With this growing interest, the green bond market looks set to continue to grow, helping to bring in the money needed for global sustainability projects.

Future of the green bond market

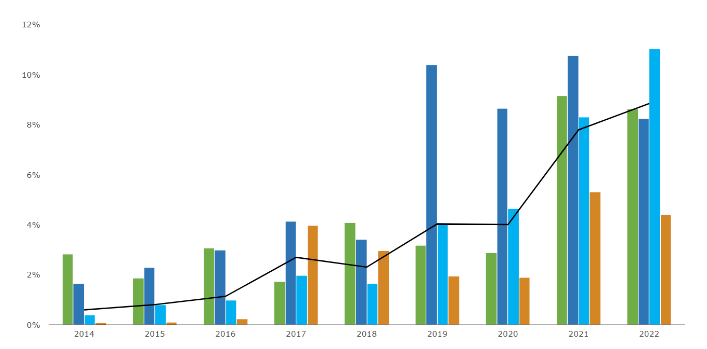

On the graph below provided by the European Environment Agency, you can see a significant growth in the percentage of issued green papers compared to the total bond issuance from 2014 up to the present moment.

As concerns about climate change continue to intensify, the market for green bonds is expected to continue growing exponentially. Top-tier investors and institutions are now increasingly setting their sights on these sustainable assets, matching stride with governments around the globe turning to green bonds as an avenue to finance their green infrastructure projects.

Investing in green bonds isn't merely a strategy to grow your wealth; it's a firm stance in support of our planet's future. It offers a unique opportunity to actively participate in crafting a more sustainable world, all while potentially reaping attractive returns. The rewards are enticing, the stakes are significant, and the door to opportunity stands wide open.

Τhe Bottom Line: Key Takeaways

Green bonds have emerged as a crucial tool in financing climate-related and environmental projects. As part of the larger movement of environmental, social, and governance (ESG) investing, they respond to the rising demand for investments that align with sustainable and socially responsible principles. With their potential tax incentives, green bonds offer an attractive option for investors looking to combine financial returns with positive environmental impact. However, note that in this growing market, investors need to conduct due diligence to ensure they know the answer to the question “What are green papers?”, understand their key features, and ensure the credibility of sustainability claims made by bond issuers.

FAQ

Who can issue green bonds?

Green bonds, funding tools for renewable and environmental projects, can be issued by governments, corporations, financial institutions, and international development bodies. These issuers attract capital from bond markets, primarily institutional investors, to finance sustainability projects and combat climate change.

Is it profitable to invest in bonds?

Investing in bonds, including green bonds, can yield consistent returns. However, profitability largely depends on interest rates, the creditworthiness of the issuer, and market conditions. Green bonds also fund sustainable projects, merging financial gains with positive environmental impact, which enhances their appeal in the capital markets.

Which bonds are profitable to buy?

Green bonds with higher interest rates issued by creditworthy entities are typically more profitable. However, factors like bond maturity, market volatility, and interest rate risk must also be considered.

Is tax paid on bonds?

Yes, bond interest, including that from green bonds, is typically taxed. However, tax laws vary by country and some may offer green bond tax incentives due to their environmental impact. Investors should consult a tax advisor or financial institution for specific tax implications related to green bond investments.

Is it worth investing in 2023 government bonds?

Investing in 2023 government bonds, including green bonds, depends on interest rates, inflation predictions, and the investor's financial objectives and risk tolerance. They're generally safe, income-yielding investments, and green bonds also support environmental sustainability.

)

)