USD to CHF Forecast for 2024 and Beyond

As one of the major driving currencies on the global economic arena, the Swiss Franc is traded in pairs with other fiat currencies, including the US Dollar. If you’re considering trading Dollar / Swiss Franc or want to make a long-term investment, it’s crucial to do thorough research – there are many aspects defining the correlation between these two assets. This article provides a USD/CHF forecast for 2024 and the upcoming years, and explains what impacts the pricing ratio of these two currencies.

Table of Contents

About the Swiss Franc (CHF) Forecast

CHF price forecast for tomorrow and the next weeks

CHF price forecast for 2024

CHF price forecast for 2025

CHF price forecast for 2026

CHF price forecast for 2027

CHF price forecast for 2028

CHF technical analysis

CHF price history

What affects the CHF price?

How to predict the price of CHF

Conclusion: Is CHF a good investment?

FAQ

About the Swiss Franc (CHF) Forecast

The USD/CHF currency pair is frequently referred to as "The Swissie." The only remaining franc in circulation in Europe is the Swiss franc. The Confoederatio Helvetica Franc, or CHF for short, stands for the currency used in Switzerland, the neutral nation state economy in the heart of Europe. For decades, Switzerland has been a safe haven for investors and holders of major sums of money thanks to its reliable and open global banking services, and because of their adherence to banking secrecy. It is still one of the best countries to store a large volume of cash. This is what allowed the Swiss Franc to grow in price significantly, while at the same time putting pressure on the country's exporters. Massive inflows into Swiss Francs exacerbated the situation when the European Debt Crisis hit the continent, leading the Swiss National Bank (SNB) to eventually establish a peg to the Euro at a rate of 1.2 Swiss Francs for every 1 Euro.

CHF price forecast for tomorrow and the next weeks

CHF today is worth 0.8697. Over the course of the next day, it is anticipated that the CHF to USD exchange rate will rise by 0.61%, from CHF today’s range of 0.86609 - 0.8690. According to estimations, the current sentiment in the CHF/USD market is bullish/bearish.

Here is a short-term USDCHF forecast by 30rates:

| Date |

Min |

Max |

Rate |

| 12/02 |

0.862 |

0.888 |

0.875 |

| 13/02 |

0.861 |

0.887 |

0.874 |

| 14/02 |

0.866 |

0.892 |

0.879 |

| 15/02 |

0.865 |

0.891 |

0.878 |

| 16/02 |

0.869 |

0.895 |

0.882 |

| 19/02 |

0.878 |

0.904 |

0.891 |

| 20/02 |

0.874 |

0.900 |

0.887 |

| 21/02 |

0.874 |

0.900 |

0.887 |

| 22/02 |

0.874 |

0.900 |

0.887 |

| 23/02 |

0.872 |

0.898 |

0.885 |

As long as the 0.9683 barrier holds, the medium-term Franc forecast is still negative overall. This year's high of 1.2004 is now falling, continuing a multi-decade downward trend. With the completion of the bounce from 0.9252, another dip is in order. Even if this is a corrective move, a strong breach of 0.9683 and continuous trading above the 55 W EMA, which is now at 0.9638, will indicate that the USD/CHF is already in a medium-term rally.

CHF price forecast for 2024

With the Swiss franc pulling back from last year’s surge, the number of bearish traders is increasing. Leading market analysts warn that a consensus has not been hammered out yet. By the end of 2024, the Franc is said to depreciate by 4% when the Swiss National Bank ceases to support it. That is more than twice as much depreciation as the average projection from economists.

CHF to USD Forecast for 2024

| Month |

Min |

Max |

Change |

| March 2024 |

1.147 |

1.154 |

0.61 % ▲ |

| April 2024 |

1.153 |

1.156 |

-0.12 %▼ |

| May 2024 |

1.147 |

1.152 |

-0.12 %▼ |

| June 2024 |

1.152 |

1.161 |

0.72 % ▲ |

| July 2024 |

1.160 |

1.169 |

0.75 % ▲ |

| August 2024 |

1.166 |

1.170 |

-0.29 %▼ |

| September 2024 |

1.155 |

1.165 |

-0.88 %▼ |

| October 2024 |

1.154 |

1.156 |

-0.07 %▼ |

| November 2024 |

1.146 |

1.154 |

-0.37 %▼ |

| December 2024 |

1.150 |

1.161 |

0.93 % ▲ |

CHF price forecast for 2025

Generally, the Swiss Franc forecast based on technical analysis is positive. CHF/USD is expected to keep within the range of 1.08 to 1.19. The lowest rate of 1.08 is expected to come in August – summer 2025 may be marked by a strengthening of the US Dollar.

CHF to USD Forecast for 2025

| Month |

Min |

Max |

Change |

| January 2025 |

1.160 |

1.165 |

0.33 % ▲ |

| February 2025 |

1.156 |

1.165 |

-0.64 %▼ |

| March 2025 |

1.157 |

1.164 |

0.59 % ▲ |

| April 2025 |

1.163 |

1.166 |

-0.07 %▼ |

| May 2025 |

1.157 |

1.163 |

-0.14 %▼ |

| June 2025 |

1.162 |

1.171 |

0.73 % ▲ |

| July 2025 |

1.170 |

1.179 |

0.77 % ▲ |

| August 2025 |

1.176 |

1.180 |

-0.29 %▼ |

| September 2025 |

1.165 |

1.176 |

-0.89 %▼ |

| October 2025 |

1.165 |

1.167 |

-0.08 %▼ |

| November 2025 |

1.157 |

1.164 |

-0.4 %▼ |

| December 2025 |

1.160 |

1.172 |

0.96 % ▲ |

CHF price forecast for 2026

For the next several years, the specialists at Long Forecast are rather bullish about the CHF/USD pair. The price may rise over $1.16 in 2026, and the pair will trade between the averages of 2024 and 2026 in 2027.

CHF to USD Forecast for 2026

| Month |

Min |

Max |

Change |

| January 2026 |

1.171 |

1.175 |

0.33 % ▲ |

| February 2026 |

1.167 |

1.175 |

-0.63 %▼ |

| March 2026 |

1.168 |

1.174 |

0.58 % ▲ |

| April 2026 |

1.174 |

1.177 |

-0.07 %▼ |

| May 2026 |

1.168 |

1.174 |

-0.18 %▼ |

| June 2026 |

1.172 |

1.181 |

0.72 % ▲ |

| July 2026 |

1.180 |

1.189 |

0.74 % ▲ |

| August 2026 |

1.186 |

1.191 |

-0.29 %▼ |

| September 2026 |

1.176 |

1.186 |

-0.84 %▼ |

| October 2026 |

1.175 |

1.177 |

-0.08 %▼ |

| November 2026 |

1.167 |

1.175 |

-0.42 %▼ |

| December 2026 |

1.170 |

1.182 |

1 % ▲ |

CHF price forecast for 2027

The 2027 CHF forecast is generally pessimistic. With the US Dollar growing in value, the ratio may go under 1 and reach 0.94-0.96. In the most optimistic scenario, the CHF to USD ratio will reach 1.06. Generally, it will keep around 1:1 with the biggest fluctuations foreseen in May and June 2027.

CHF to USD Forecast for 2027

| Month |

Min |

Max |

Change |

| January 2027 |

1.181 |

1.186 |

0.31 % ▲ |

| February 2027 |

1.177 |

1.185 |

-0.63 %▼ |

| March 2027 |

1.178 |

1.185 |

0.6 % ▲ |

| April 2027 |

1.184 |

1.187 |

-0.06 %▼ |

| May 2027 |

1.178 |

1.184 |

-0.21 %▼ |

| June 2027 |

1.182 |

1.192 |

0.77 % ▲ |

| July 2027 |

1.191 |

1.200 |

0.72 % ▲ |

| August 2027 |

1.197 |

1.201 |

-0.29 %▼ |

| September 2027 |

1.186 |

1.197 |

-0.85 %▼ |

| October 2027 |

1.185 |

1.187 |

-0.08 %▼ |

| November 2027 |

1.177 |

1.185 |

-0.45 %▼ |

| December 2027 |

1.180 |

1.193 |

0.99 % ▲ |

CHF price forecast for 2028

The pessimistic outlook of 2027 is applied to 2028 as well. In the worst-case scenario, the USDCHF forecast will be around 0.89. The decline will start in January, when CHF starts nosediving from the 0.99 level.

CHF to USD Forecast for 2028

| Month |

Min |

Max |

Change |

| January 2028 |

1.191 |

1.196 |

0.29 % ▲ |

| February 2028 |

1.188 |

1.195 |

-0.63 %▼ |

| March 2028 |

1.188 |

1.196 |

0.61 % ▲ |

| April 2028 |

1.194 |

1.197 |

-0.11 %▼ |

| May 2028 |

1.189 |

1.194 |

-0.13 %▼ |

| June 2028 |

1.193 |

1.202 |

0.71 % ▲ |

| July 2028 |

1.201 |

1.210 |

0.71 % ▲ |

| August 2028 |

1.207 |

1.211 |

-0.26 %▼ |

| September 2028 |

1.197 |

1.207 |

-0.83 %▼ |

| October 2028 |

1.195 |

1.198 |

-0.13 %▼ |

| November 2028 |

1.188 |

1.195 |

-0.35 %▼ |

| December 2028 |

1.191 |

1.203 |

0.92 % ▲ |

CHF technical analysis

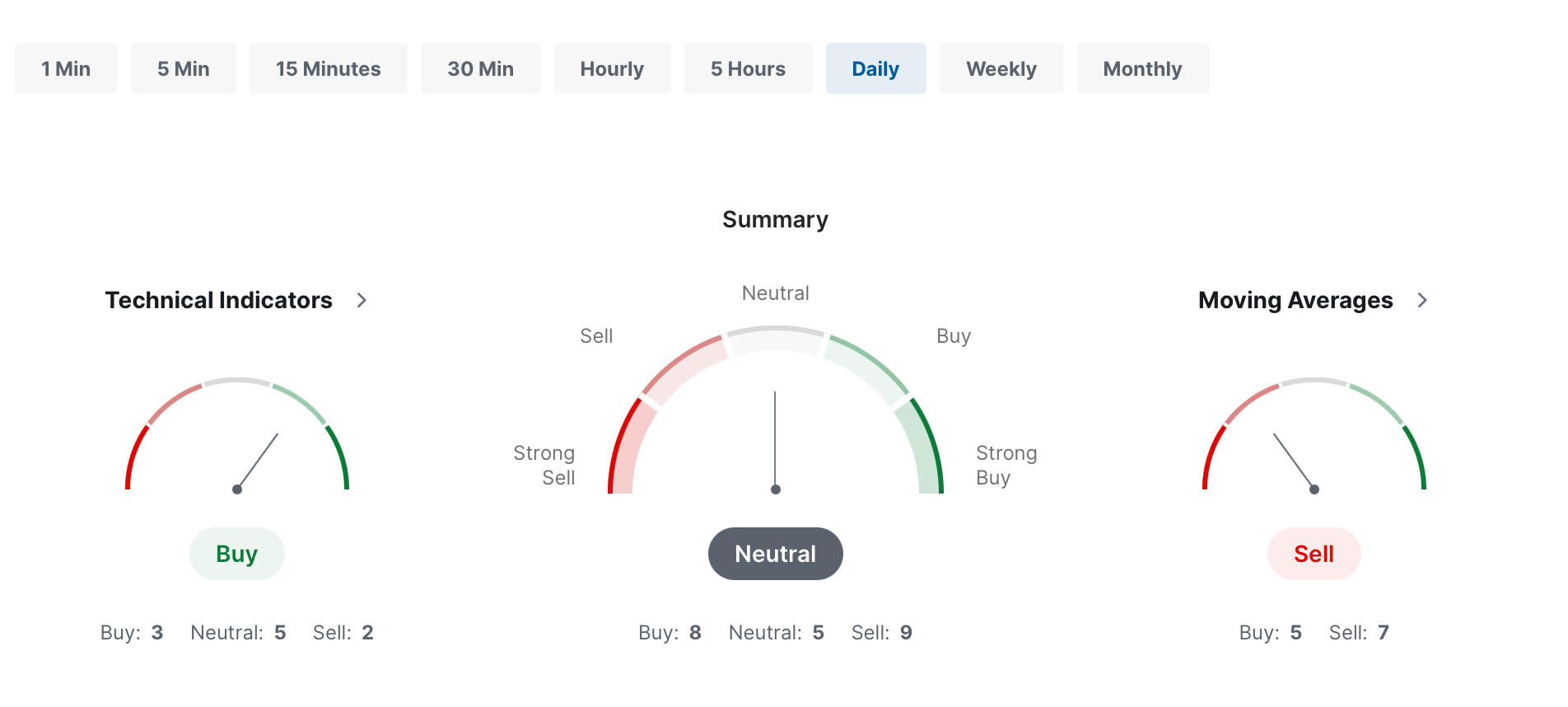

If we observe CHF/USD on a daily time frame, the indicators are generally neutral. The market is indecisive – there is no bearish or bullish trend, or signs of them. On hourly time frames, the majority of indicators suggest selling off.

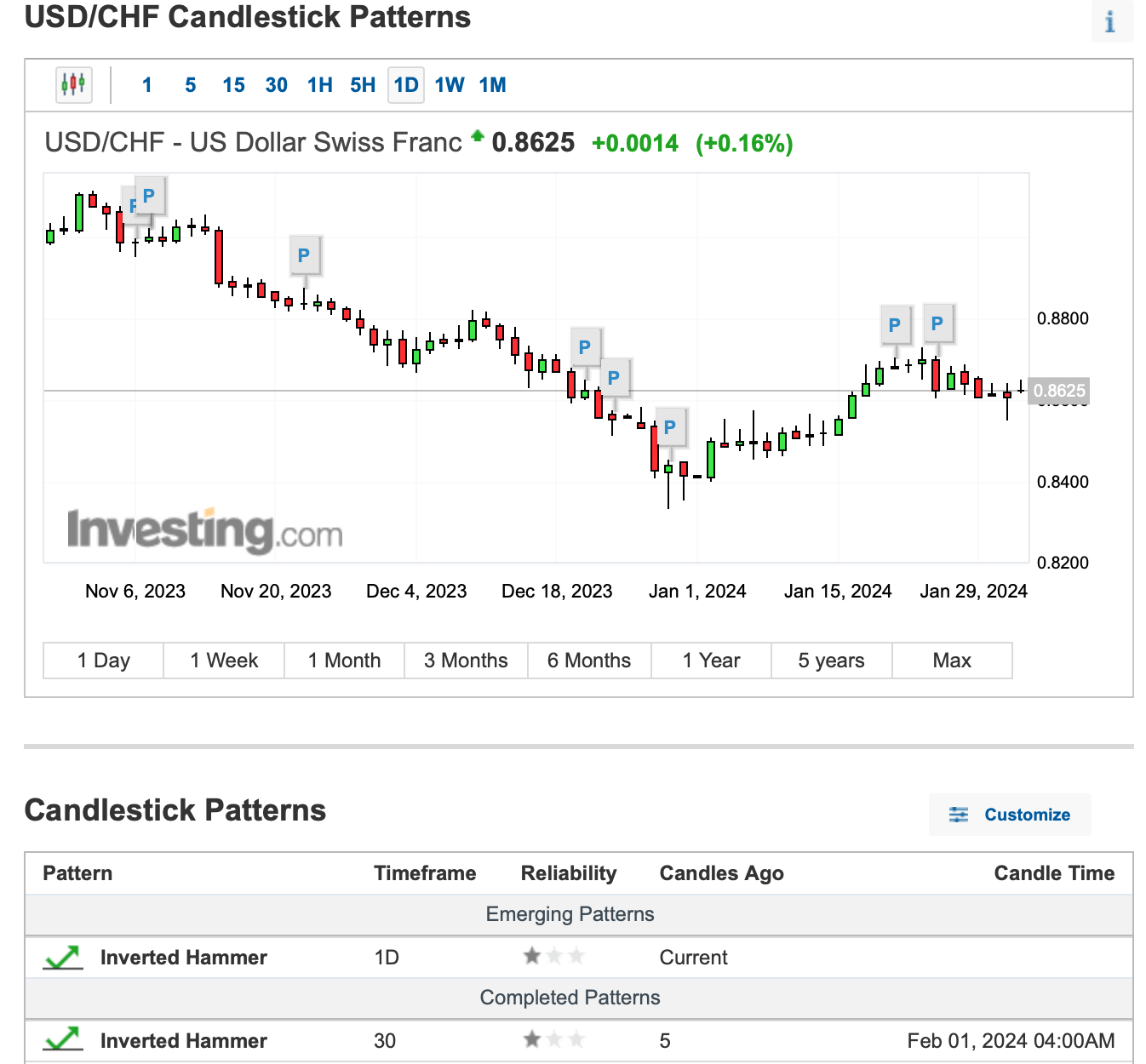

When it comes to emerging patterns, you can notice an inverted hammer forming. It suggests a short-term trend reversal. Such a formation happens when prices are almost back to their lowest points following a protracted sell-off.

CHF price history

Judging by historical price data, the Swiss Franc is gaining strength after poor performance in 2022. The Dollar’s weakening position is explained by geopolitical events and inflation concerns in the USA. The Swiss Franc (CHF) surpassed the other main G-10 currencies to become the dominant currency in 2023. The figures are clear: the value of the CHF increased by 2.9% vs the British Pound, 5.1% versus the Euro, and 8.3% versus the Dollar. It increased significantly by 17.5% compared to the Japanese Yen and made strong gains in relation to other currencies.

CHF’s recent price moves are the following:

| Date |

Price |

Change % |

| 02/09/2024 |

0.8746 |

+0.11% |

| 02/08/2024 |

0.8736 |

-0.08% |

| 02/07/2024 |

0.8743 |

+0.55% |

| 02/06/2024 |

0.8695 |

-0.11% |

| 02/05/2024 |

0.8705 |

+0.47% |

| 02/02/2024 |

0.8664 |

+1.05% |

| 02/01/2024 |

0.8574 |

-0.43% |

| 01/31/2024 |

0.8611 |

-0.06% |

| 01/30/2024 |

0.8616 |

+0.06% |

| 01/29/2024 |

0.8611 |

-0.38% |

| 01/26/2024 |

0.8644 |

-0.27% |

| 01/25/2024 |

0.8667 |

+0.46% |

| 01/24/2024 |

0.8627 |

-0.86% |

What affects the CHF price?

The US dollar's and the Swiss franc's relative values to one another and other currencies have an impact on the USD/CHF exchange rate. Two major factors influencing the currency pair are employment data and the GDP of both nations.

This currency pair will also be impacted by the difference in interest rates between the Fed and the SNB. For instance, the value of the USD/CHF might rise as a result of the US dollar appreciating relative to the Swiss franc when the Fed engages in open market operations to boost the US currency.

However, if interest rates are raised by the Swiss National Bank, more investors may be drawn to the Franc, which would enhance its value. Since it will take less Francs to purchase one USD in this scenario, the USD/CHF exchange rate will decrease.

USD/CHF has a negative correlation with EUR/USD and GBP/USD because the British pound, the Euro, and the Swiss franc all have positive correlations.

How to predict the price of CHF

Aside from the above-mentioned signs of bearish or bullish trends (changes in banks’ interest rates and employment data), you should also consider other crucial factors. These include:

-

Political stability in Switzerland and events in the EU can affect investor confidence and impact currency prices.

- Low inflation rates are generally associated with currency strength, as the purchasing power remains relatively stable.

- A positive trade balance (exports > imports) can contribute to a stronger currency because Switzerland is one of the major markets in international trade.

- Global risk sentiment is another driving point. The Swiss Franc is often considered a safe-haven currency. During times of global economic uncertainty or geopolitical tensions stocks are seen as unreluable assets, so investors may seek refuge in the CHF, leading to its appreciation.

Conclusion: Is CHF a good investment?

This question does not have an unambiguous answer, because everything depends on the time frame you consider. If you regard CHF as a trading instrument in your account, it might be a good idea to buy it for short and middle terms. If you want to invest in the long term, think twice – technical analyses made by AI suggest that the Dollar will regain its strong position during the upcoming years.

FAQ

What is the forecast for the USD/CHF pair in 2024?

During 2024, the Swiss Franc is expected to slightly depreciate against the US Dollar (around 4% weakening is forecasted by experts). Hence, the USD/CHF ratio might change from the current 1.16 to 1.12 and below.

What is the projection for CHF/USD?

During 2024, CHF will start losing its positions against the US Dollar. The weakest period is expected from June 2024 to September 2024: this is when the CHF/USD ratio may fall to 1.06. A lot depends on the interest rates of the Swiss National Bank (SNB) and geopolitical events in the USA.

Is the CHF getting stronger?

The Swiss Franc started regaining its strong position by the beginning of 2024, but this growth seems to be slowing down. Everything points to the strengthening of the US Dollar. Both technical analyses and experts’ predictions indicate that Dollar Swiss Franc may start trading at a 1:1 ratio in the near future.

Is USD/CHF a good pair to trade?

Since USD/CHF is one of the top 10 currency pairs for trading, it is a good idea to include it in your trading portfolio. You can operate this pair on many official exchanges, and trade it on Forex. However, don’t forget to do your own research before investing your money, and never spend more than you can afford to lose.