USD/JPY Forecast for 2024 and Beyond

)

Table of Contents

Key Takeaways

USD/JPY Currency Rate Forecast Summary

Short-term USD/JPY price forecast for 2024

USD/JPY technical analysis

USD/JPY Price History

USD/JPY Forecast for 2025

USD/JPY Forecast for 2026

USD/JPY Forecast for 2027

USD/JPY Forecast for 2028

What Affects the Dollar to Yen Rate?

How to Predict the Dollar to Yen Exchange Rate

Conclusion

FAQs

With the Japanese national currency being one of the top Forex traders’ choices, the yen exchange rate forecast is always a big question. This article provides insights into experts’ opinions about the future of the Japanese yen, as well as technical analysis of the pair rate, and predictions from 2024 to 2028. Aside from seeing the Japanese yen forecast, you will also find out what factors define its price, and how to make data-driven projections.

Key Takeaways

-

The USD/JPY pair is expected to keep moving slightly down by the end of 2024.

- In 2025 analysts predict the USD to JPY rate to enter a bullish trend and reach around 160 by the year-end.

- In the long run, US Dollar to Yen rate is expected to continue growing hitting the level of 200 in 2028.

USD/JPY Currency Rate Forecast Summary

Recent trends show USD/JPY hovering around 148-150 in 2024, driven by divergent monetary policies between the Fed and the Bank of Japan.

In 2025 analysts predict moderate growth of the currency pair, targeting a range of 145-160, as Japan could gradually tighten policy.

The long-term projection indicates slight volatility with an overall bullish trend for the exchange rate, with USD/JPY hitting the mark of 200 in 2028.

| Year |

Year Low |

Year High |

| 2024 |

¥ 135.17 |

¥ 145.34 |

| 2025 |

¥ 113.60 |

¥ 145.96 |

| 2026 |

¥ 124.75 |

¥ 134.80 |

| 2027 |

¥ 107.25 |

¥ 130.15 |

| 2028 |

¥ 115.55 |

¥ 126.84 |

| 2029 |

¥ 112.39 |

¥ 122.78 |

| 2030 |

¥ 112.83 |

¥ 120.31 |

Short-term USD/JPY price forecast for 2024

The USD to JPY forecast tomorrow and on shows the pair is expected to be traded near current levels, with a slight potential decrease. The forecasted range for 2024 is between 138 and 144 Japanese yen, reflecting stability in the current USD trends.

| Month |

Open |

Low-High |

Close |

Change |

| Oct |

144 |

139-149 |

143 |

-0.7% |

| Nov |

143 |

140-146 |

142 |

-1.4% |

| Dec |

142 |

138-142 |

140 |

-2.8% |

USD/JPY technical analysis

From July to mid-September, USD/JPY faced a bearish trend, reflecting weakening momentum in the pair.

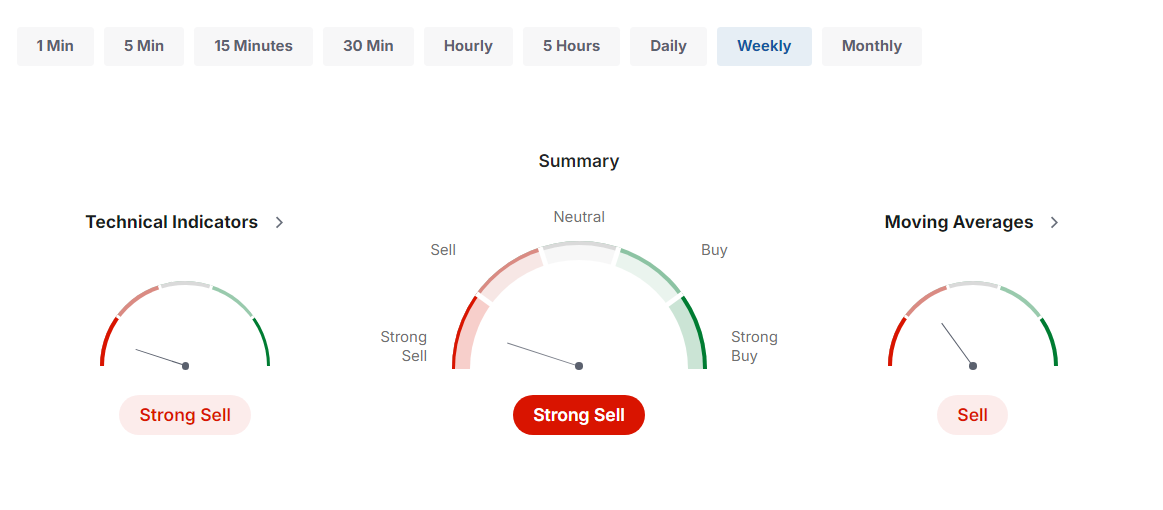

The weekly chart indicates a bearish outlook prediction. Moving averages show 5 buys and 7 sells, signaling more downside pressure. Meanwhile, technical indicators point to a strong sell signal with 11 sells and no buys, highlighting intensified bearish sentiment.

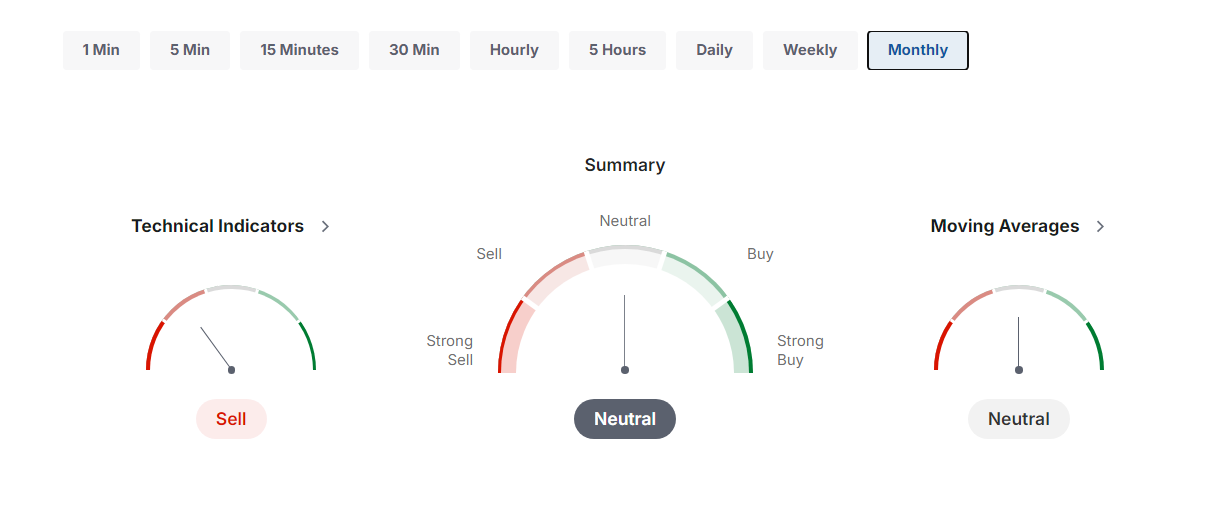

On the monthly chart, the overall sentiment is also neutral. Moving averages remain balanced at 6 buys and 6 sells, while technical indicators suggest a bearish tilt, with 5 sells and 2 buys.

USD/JPY Price History

During 2023, the USD/JPY rate kept within the range of 130 to 152, with the US dollar showing signs of moderate growth. A combination of global events, central bank policies, and economic indicators led to a notable 19% gain in the rate in 2023. Throughout the year, the USD/JPY pair reached a high of 151.93 in November due to the difference between the US's rising interest rates and Japan's stable policies.

By December 2023, the USD/JPY rate stabilized around 145 as the Fed loosened its stance and Japan stuck to its policies.

In 2024, the USD to JPY exchange rate experienced significant fluctuations. Starting at ¥146.01 in January, it climbed steadily, peaking in June at ¥157.91. However, the rate began to decline in the second half of the year, falling to ¥143.11 by September.

| Month |

Average Price |

| October 2023 |

¥149.55 |

| November 2023 |

¥149.71 |

| December 2023 |

¥143.74 |

| January 2024 |

¥146.01 |

| February 2024 |

¥149.60 |

| March 2024 |

¥149.76 |

| April 2024 |

¥153.89 |

| May 2024 |

¥155.84 |

| June 2024 |

¥157.91 |

| July 2024 |

¥157.62 |

| August 2024 |

¥146.07 |

| September 2024 |

¥143.11 |

USD/JPY Forecast for 2025

The USD to JPY forecast for 2025 suggests a gradual rise from today’s range, with potential drops in July. However, the overall prediction trend shows steady growth, reaching up to ¥160.54 by year-end, reflecting positive movement despite slight fluctuations.

USD to JPY Forecast for 2025

| Month |

Min |

Max |

Change |

| January 2025 |

146.271 |

146.590 |

0.22 % ▲ |

| February 2025 |

146.640 |

148.559 |

1.29 % ▲ |

| March 2025 |

148.584 |

149.964 |

0.92 % ▲ |

| April 2025 |

150.064 |

151.710 |

1.09 % ▲ |

| May 2025 |

151.733 |

152.965 |

0.81 % ▲ |

| June 2025 |

153.015 |

154.216 |

0.78 % ▲ |

| July 2025 |

154.001 |

154.505 |

-0.17 % ▼ |

| August 2025 |

153.895 |

154.737 |

0.5 % ▲ |

| September 2025 |

154.791 |

156.603 |

1.16 % ▲ |

| October 2025 |

156.676 |

158.353 |

1.06 % ▲ |

| November 2025 |

158.416 |

159.755 |

0.84 % ▲ |

| December 2025 |

159.784 |

160.545 |

0.47 % ▲ |

USD/JPY Forecast for 2026

The USD to Japanese yen forecast for 2026 shows a steady rise, particularly during the Asian session in the forex market. Despite a small drop in July, the pair is expected to reach ¥174.82 by year-end, maintaining an upward trajectory throughout the year.

USD to JPY Forecast for 2026

| Month |

Min |

Max |

Change |

| January 2026 |

160.550 |

160.869 |

0.2 % ▲ |

| February 2026 |

160.931 |

162.843 |

1.17 % ▲ |

| March 2026 |

162.882 |

164.260 |

0.84 % ▲ |

| April 2026 |

164.331 |

165.984 |

1 % ▲ |

| May 2026 |

166.013 |

167.260 |

0.75 % ▲ |

| June 2026 |

167.322 |

168.522 |

0.71 % ▲ |

| July 2026 |

168.298 |

168.812 |

-0.15 % ▼ |

| August 2026 |

168.186 |

169.046 |

0.46 % ▲ |

| September 2026 |

169.098 |

170.869 |

1.04 % ▲ |

| October 2026 |

170.938 |

172.629 |

0.98 % ▲ |

| November 2026 |

172.704 |

174.071 |

0.79 % ▲ |

| December 2026 |

174.091 |

174.823 |

0.41 % ▲ |

USD/JPY Forecast for 2027

The USD to JPY forecast for 2027 shows steady growth in the forex market, with buyers driving the pair higher despite minor volatility in the middle of the year. Overall, the results point to consistent upward movement, reaching ¥189.10 by year-end, reflecting strong demand.

USD to JPY Forecast for 2027

| Month |

Min |

Max |

Change |

| January 2027 |

174.835 |

175.162 |

0.19 % ▲ |

| February 2027 |

175.235 |

177.140 |

1.08 % ▲ |

| March 2027 |

177.192 |

178.527 |

0.75 % ▲ |

| April 2027 |

178.594 |

180.264 |

0.93 % ▲ |

| May 2027 |

180.296 |

181.567 |

0.7 % ▲ |

| June 2027 |

181.627 |

182.800 |

0.64 % ▲ |

| July 2027 |

182.599 |

183.113 |

-0.12 % ▼ |

| August 2027 |

182.482 |

183.353 |

0.42 % ▲ |

| September 2027 |

183.377 |

185.131 |

0.95 % ▲ |

| October 2027 |

185.207 |

186.918 |

0.92 % ▲ |

| November 2027 |

187.005 |

188.384 |

0.73 % ▲ |

| December 2027 |

188.377 |

189.107 |

0.38 % ▲ |

USD/JPY Forecast for 2028

The USD to JPY forecast for 2028 predicts steady gains, with the pair expected to hit the ¥200 level. This bullish trend reflects continued upward momentum, showing consistent growth throughout the year, driven by strong market conditions and positive sentiment.

USD to JPY Forecast for 2028

| Month |

Min |

Max |

Change |

| January 2028 |

189.123 |

189.467 |

0.18 % ▲ |

| February 2028 |

189.537 |

191.500 |

1.03 % ▲ |

| March 2028 |

191.519 |

192.863 |

0.7 % ▲ |

| April 2028 |

192.939 |

194.593 |

0.85 % ▲ |

| May 2028 |

194.650 |

195.904 |

0.64 % ▲ |

| June 2028 |

195.932 |

197.103 |

0.59 % ▲ |

| July 2028 |

196.901 |

197.408 |

-0.12 % ▼ |

| August 2028 |

196.785 |

197.652 |

0.38 % ▲ |

| September 2028 |

197.678 |

199.479 |

0.9 % ▲ |

| October 2028 |

199.569 |

201.304 |

0.86 % ▲ |

| November 2028 |

201.361 |

202.669 |

0.64 % ▲ |

| December 2028 |

202.664 |

203.423 |

0.37 % ▲ |

What Affects the Dollar to Yen Rate?

The USD/JPY exchange rate is influenced by several factors, including:

-

The monetary policies of the Federal Reserve and the Bank of Japan

- Economic indicators (for example, GDP growth and employment rates)

- Geopolitical tensions

- Trade balances

- Investors’ sentiment towards risk

Additionally, fluctuations in global commodity prices (particularly oil), and the overall health of the global economy also play a significant role in shaping the exchange rate between the US dollar and the Japanese yen.

How to Predict the Dollar to Yen Exchange Rate

Predicting the dollar/yen exchange rate involves analyzing economic indicators, central bank policies, geopolitical events, and market sentiment. Utilizing techniques like technical analysis, which examines historical price patterns, and fundamental analysis, which assesses economic factors, can aid in forecasting.

Factors such as interest rate differentials, inflation rates, trade balances, and political stability also impact predictions. Moreover, monitoring news and developments that could affect the US and Japanese economies helps refine yen forecast. However, exchange rate prediction is inherently uncertain due to the complexity of global markets and unforeseen events.

Conclusion

As a popular trading Forex pair, USD/JPY is a nice option for both short and long-term trading. However, before placing your orders, do your research on both currencies and try to analyze their further movements. While the majority of technical AI-generated forecasts imply strengthening of the US dollar, you should keep your finger on the pulse of the market, national economies and geopolitical events.

FAQs

Will the US dollar get stronger against the Japanese yen in 2024?

Forecasts vary, but overall, the trend is expected to be neutral to slightly positive, with potential for modest gains in the USD to JPY exchange rate in 2024.

What is the forecast for USD to JPY in 2025?

The forecast is bullish, with the USD to JPY rate expected to reach ¥160.545 by the end of 2025.

Will the USD to JPY exchange rate fall / drop?

The dollar to yen forecast shows potential short-term drops, but analysts expect a generally bullish trend, with any declines being temporary.

What will the USD/JPY FX rate be worth in five years (2028)?

According to forecasts, the USD to JPY is expected to reach ¥200 by 2028, showing steady growth over the period.

Will the USD/JPY FX rate crash?

There is no indication from current data or analysts suggesting a crash, though market volatility and global economic factors could cause fluctuations.

Will the USD/JPY exchange rate hit 500 in a year?

The dollar to yen forecast shows no data supporting such extreme growth, with rates expected to remain far below 500.

Will the USD/JPY exchange rate hit 1000 in a year?

It is highly unlikely, as negative rates and current market trends suggest such a level is not achievable within the next year.