SEK to USD Forecast for 2024, 2025 and Beyond

As one of key currencies in the European zone and one of top 20 national fiats, the Swedish krona is widely used for trading and investing. A vast volume is traded in pairs with the Euro and the US Dollar, which makes the currency prone to moderate fluctuations. Want to trade the USD/SEK pair and wonder how its price will change in the coming days, weeks, and years? This ultimate guide will provide both a long-term Swedish Krona forecast and short-term projections – all based on technical AI-driven analysis and experts’ opinions.

Table of Contents

About the USD/SEK Currency Rate Forecast

SEK Price Forecast for Tomorrow and the Coming Weeks

SEK Technical Analysis

SEK Price History

What Affects the SEK Price?

USD to SEK Price Forecast for 2024

USD to SEK Forecast for 2025

USD to SEK Forecast for 2026

USD to SEK Forecast for 2027

USD to SEK Forecast for 2028

How to Predict the Price of SEK

Conclusion: Is SEK a Good Investment?

FAQ

About the United States Dollar (USD) / Swedish Krona (SEK) currency rate forecast

The Swedish krona is the official currency of Sweden, it has the SEK ticker. Since the Swedish word “krona” is translated as "crown," it can also be denoted as the Swedish crown. The Sveriges Riksbank (the Swedish Central Bank), or Riksbanken, mints SEK banknotes and coins.

Representing one of the world’s top 20 wealthiest economies, SEK is traded on Forex and many exchanges. USD and EUR are the most commonly used currencies to trade in pairs with SEK. Since 1992, the currency has been under free market exchange rates with other global currencies. Riksbanken does all it can to keep the SEK value stable. Denmark and Norway also use the krona as their national currency.

SEK price forecast for tomorrow and the coming weeks

If we look at the short term, there is no clear bullish or bearish trend forming. SEK is now moving sideways, exhibiting minor fluctuations. Tomorrow, the SEK/USD price is not expected to change significantly: it is expected to stay in the range of 10.5 to 10.7.

| Date |

Min |

Max |

Rate |

| 12/02 |

10.26 |

10.58 |

10.42 |

| 13/02 |

10.26 |

10.58 |

10.42 |

| 14/02 |

10.23 |

10.55 |

10.39 |

| 15/02 |

10.14 |

10.44 |

10.29 |

| 16/02 |

10.24 |

10.56 |

10.40 |

| 19/02 |

10.35 |

10.67 |

10.51 |

| 20/02 |

10.34 |

10.66 |

10.50 |

| 21/02 |

10.32 |

10.64 |

10.48 |

| 22/02 |

10.29 |

10.61 |

10.45 |

In the near weeks, SEK can climb to the 10.6 level and stay there. No significant movements are expected, unless there is serious news or events that affect the European zone.

SEK technical analysis

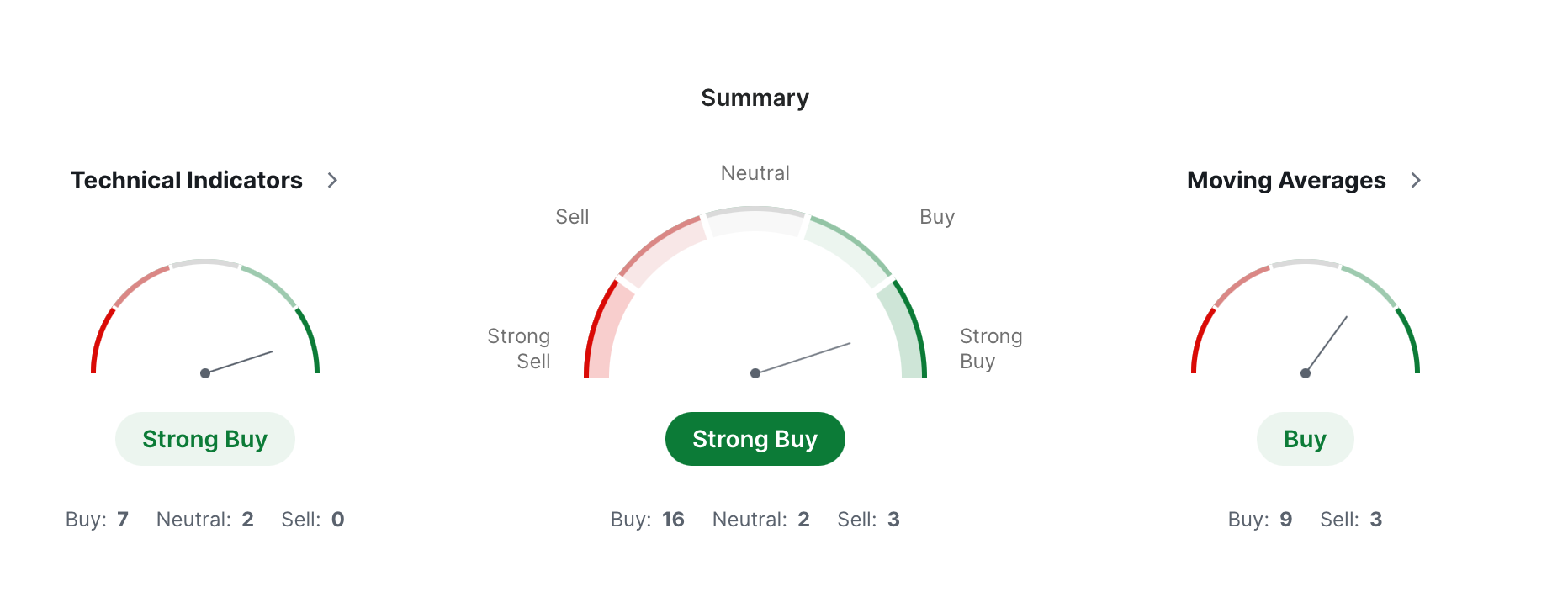

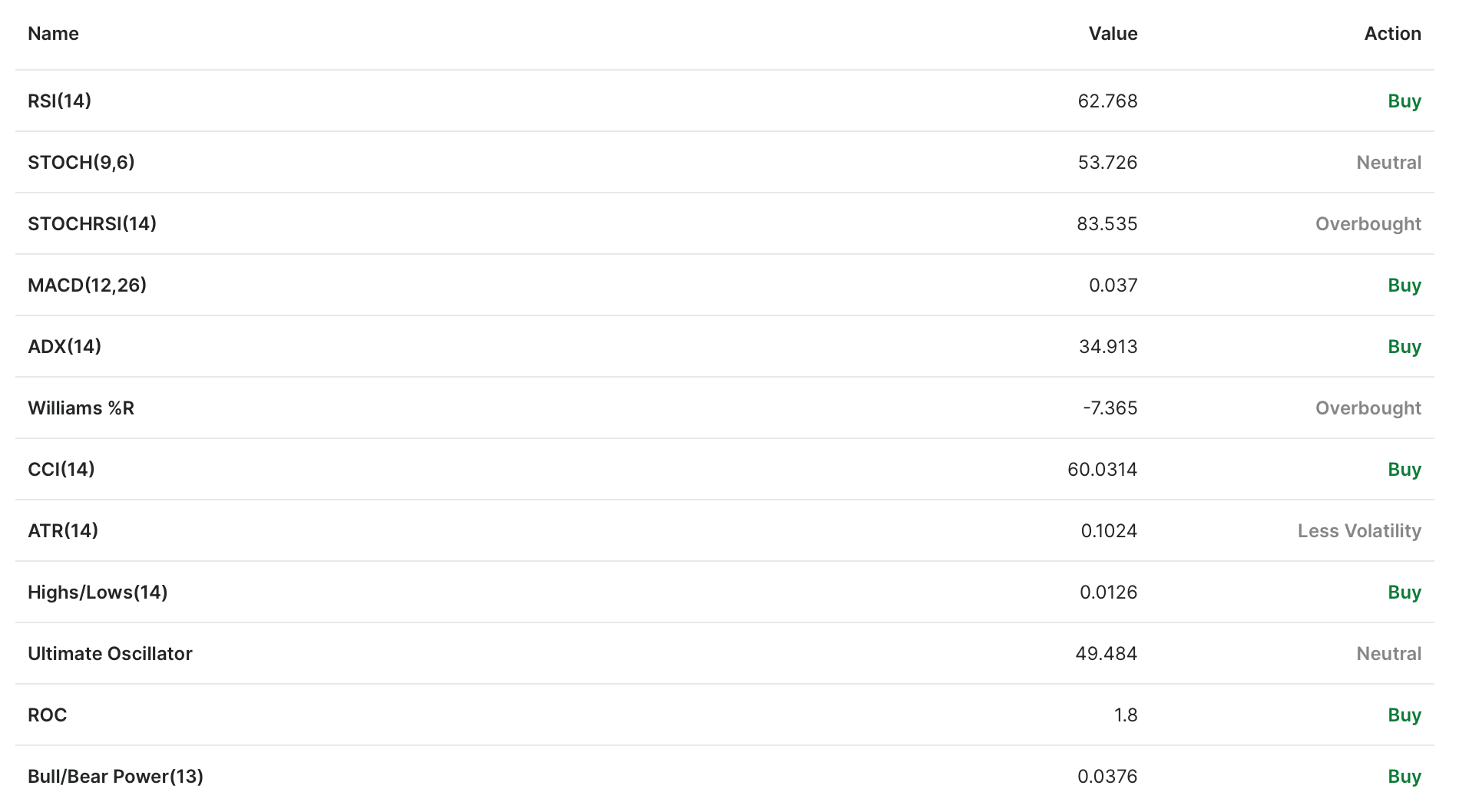

If we take a look at the technical indicators, most of them signify traders’ bearish sentiments – it’s high time to enter the market and purchase SEK.

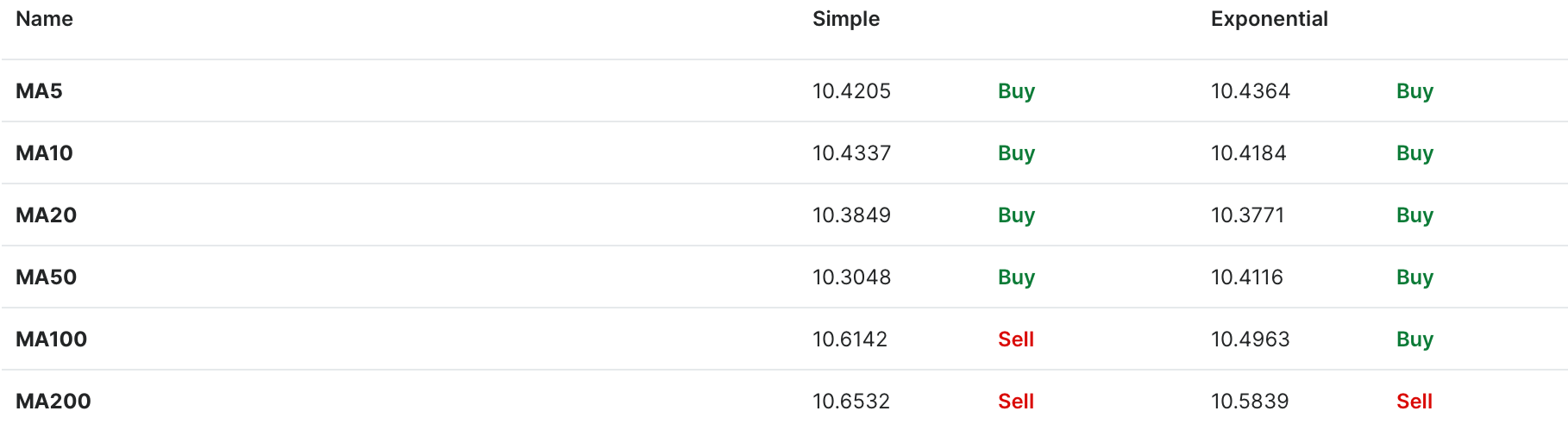

This specifically applies to moving averages of all ranges:

Other technical indicators also show positive signs of upcoming SEK growth, except for STOCH, which shows overbuying.

SEK Price History

Over the last couple of weeks, SEK has been exhibiting slight signs of an uptrend. The SEK price has grown from 10.4 to 10.5 on average, and this slight uptrend is continuing.

| Date |

Rate |

Min |

Max |

| 2024-02-11 |

10.523 |

10.463 |

10.588 |

| 2024-02-12 |

10.541 |

10.479 |

10.603 |

| 2024-02-13 |

10.555 |

10.492 |

10.617 |

| 2024-02-14 |

10.532 |

10.471 |

10.595 |

| 2024-02-15 |

10.534 |

10.475 |

10.596 |

| 2024-02-16 |

10.534 |

10.471 |

10.593 |

| 2024-02-17 |

10.558 |

10.497 |

10.613 |

| 2024-02-18 |

10.553 |

10.487 |

10.624 |

| 2024-02-19 |

10.571 |

10.513 |

10.638 |

| 2024-02-20 |

10.585 |

10.520 |

10.645 |

What Affects the SEK Price?

The SEK/USD rate depends on the following aspects:

-

The higher interest rates of central banks, including the Swedish Riksbank, attract foreign capital seeking better returns. Consequently, this triggers an increase in currency demand and can potentially improve SEK’s position on the global market.

- Economic indicators, including GDP growth, unemployment rates, and manufacturing output, altogether impact the currency's value. Strong economic performance generally strengthens a currency.

- Low inflation rates contribute to a currency’s stability and growth. Central banks alter interest rates to control inflation, and Riksbank is no exception.

- Political stability in Sweden and the broader European region can impact investor confidence. Uncertainty and unpredictability of currency performance keeps investors at bay.

- Sweden's trade balance (the difference between exports and imports) affects the value of the national currency. A trade surplus (more exports than imports) makes a stronger currency.

- Economic conditions in major trading partners and globally can influence the SEK. For instance, downturns in major markets may affect demand for Swedish exports, which will take a toll on the SEK in turn.

- Sweden is a major exporter of commodities, such as iron ore and forestry products. Changes in the volume of exports impacts a country's revenue and, subsequently, the SEK.

- The Swedish Riksbank’s monetary policies directly impact the krona. This includes decisions on interest rates, quantitative easing, and other measures taken for achieving economic stability.

- Traders’ and investors' speculative activities, as well as their sentiment and perceptions of future economic conditions and geopolitical events drive their behavior. Hence, changes in the volume of purchases and sales cause short-term price fluctuations in the SEK.

USD to SEK Price Forecast for 2024

In the first part of 2024 (Q1-Q2), the US Dollar (USD) is expected to trade at the ratio 10.6857 versus the Swedish Krona (SEK), which would be 1.04% higher than the current price.

In eight months (until Q3 2024), the USD/SEK exchange rate can correct to 10.3, which would be 2.6% lower than the current level.

Looking at the longer-term picture, the US dollar to Swedish krona exchange rate might drop 4.2% to 10.1317 in around eleven months (Q4 2024). After then, the value may decrease by 4.67% to 10.0825 in about fourteen months (Q1 2025), 7.29% to 9.805 in approximately seventeen months (Q2 2025), and 6.96% to 9.84 in approximately twenty months (Q3 2025).

USD to SEK Forecast for 2024

| Month |

Min |

Max |

Change |

| March 2024 |

10.687 |

10.722 |

-0.15 %▼ |

| April 2024 |

10.703 |

10.747 |

0.41 % ▲ |

| May 2024 |

10.748 |

10.849 |

0.87 % ▲ |

| June 2024 |

10.830 |

10.931 |

0.83 % ▲ |

| July 2024 |

10.837 |

10.938 |

-0.88 %▼ |

| August 2024 |

10.839 |

10.963 |

1.13 % ▲ |

| September 2024 |

10.962 |

11.050 |

0.78 % ▲ |

| October 2024 |

11.054 |

11.164 |

0.99 % ▲ |

| November 2024 |

11.173 |

11.241 |

0.61 % ▲ |

| December 2024 |

11.219 |

11.240 |

-0.09 %▼ |

USD to SEK Forecast for 2025

The 2025 projection for SEK is generally positive. According to technical analysis based on historical performance, overall market trends and technical indicators, the Swedish krona will experience an upward movement in 2025. It should also be noted that no major retracements are expected on this path.

USD to SEK Forecast for 2025

| Month |

Min |

Max |

Change |

| January 2025 |

11.230 |

11.345 |

1.02 % ▲ |

| February 2025 |

11.349 |

11.513 |

1.43 % ▲ |

| March 2025 |

11.486 |

11.521 |

-0.15 %▼ |

| April 2025 |

11.502 |

11.543 |

0.35 % ▲ |

| May 2025 |

11.547 |

11.648 |

0.82 % ▲ |

| June 2025 |

11.631 |

11.728 |

0.75 % ▲ |

| July 2025 |

11.636 |

11.738 |

-0.81 %▼ |

| August 2025 |

11.642 |

11.762 |

1.02 % ▲ |

| September 2025 |

11.761 |

11.849 |

0.73 % ▲ |

| October 2025 |

11.850 |

11.966 |

0.97 % ▲ |

| November 2025 |

11.972 |

12.041 |

0.57 % ▲ |

| December 2025 |

12.018 |

12.038 |

-0.1 %▼ |

USD to SEK Forecast for 2026

Similarly to 2025, the next year, 2026, will be marked by continuous growth almost without retracements. SEK is expected to grow by almost 1% every month. However, it should be noted that such a technical analysis does not consider possible significant shifts in the American and Swedish economies.

USD to SEK Forecast for 2026

| Month |

Min |

Max |

Change |

| January 2026 |

12.030 |

12.145 |

0.95 % ▲ |

| February 2026 |

12.148 |

12.313 |

1.34 % ▲ |

| March 2026 |

12.285 |

12.322 |

-0.14 %▼ |

| April 2026 |

12.298 |

12.343 |

0.36 % ▲ |

| May 2026 |

12.349 |

12.448 |

0.75 % ▲ |

| June 2026 |

12.430 |

12.527 |

0.71 % ▲ |

| July 2026 |

12.437 |

12.538 |

-0.7 %▼ |

| August 2026 |

12.441 |

12.560 |

0.94 % ▲ |

| September 2026 |

12.559 |

12.644 |

0.66 % ▲ |

| October 2026 |

12.649 |

12.765 |

0.9 % ▲ |

| November 2026 |

12.770 |

12.841 |

0.54 % ▲ |

| December 2026 |

12.817 |

12.838 |

-0.1 %▼ |

USD to SEK Forecast for 2027

A positive outlook on SEK continues in 2027. It is expected to surpass the 13.00 threshold and continue climbing to the 14.00 level. However, such price predictions are very unreliable because three years is a long time, and economic conditions can change drastically.

USD to SEK Forecast for 2027

| Month |

Min |

Max |

Change |

| January 2027 |

12.832 |

12.943 |

0.86 % ▲ |

| February 2027 |

12.945 |

13.111 |

1.27 % ▲ |

| March 2027 |

13.084 |

13.122 |

-0.14 %▼ |

| April 2027 |

13.098 |

13.145 |

0.36 % ▲ |

| May 2027 |

13.148 |

13.246 |

0.7 % ▲ |

| June 2027 |

13.229 |

13.323 |

0.63 % ▲ |

| July 2027 |

13.237 |

13.337 |

-0.66 %▼ |

| August 2027 |

13.240 |

13.359 |

0.89 % ▲ |

| September 2027 |

13.358 |

13.444 |

0.64 % ▲ |

| October 2027 |

13.451 |

13.563 |

0.82 % ▲ |

| November 2027 |

13.567 |

13.640 |

0.53 % ▲ |

| December 2027 |

13.617 |

13.638 |

-0.05 %▼ |

USD to SEK Forecast for 2028

2028 may be marked by an almost 40% rise from the current levels – SEK may overcome the 14.00 threshold. Similar to previous years, its upward path will be marked by 0.5-1% growth month over month. Still, 2028 is the very distant future, so this technical analysis cannot be considered reliable enough – there are many aspects that may pop up.

USD to SEK Forecast for 2028

| Month |

Min |

Max |

Change |

| January 2028 |

13.631 |

13.741 |

0.8 % ▲ |

| February 2028 |

13.744 |

13.912 |

1.21 % ▲ |

| March 2028 |

13.884 |

13.921 |

-0.09 %▼ |

| April 2028 |

13.903 |

13.947 |

0.31 % ▲ |

| May 2028 |

13.949 |

14.047 |

0.62 % ▲ |

| June 2028 |

14.028 |

14.129 |

0.67 % ▲ |

| July 2028 |

14.039 |

14.135 |

-0.67 %▼ |

| August 2028 |

14.039 |

14.158 |

0.83 % ▲ |

| September 2028 |

14.162 |

14.250 |

0.62 % ▲ |

| October 2028 |

14.254 |

14.365 |

0.77 % ▲ |

| November 2028 |

14.367 |

14.440 |

0.47 % ▲ |

| December 2028 |

14.418 |

14.439 |

-0.06 %▼ |

How to predict the price of SEK

To make a SEK price forecast, you should pay attention to the state of the Swedish economy and what is happening with the second currency it is traded together with. When it comes to national fiat commodities, you need to keep tabs on news and announcements to see how these currencies may perform in the near days and the long term.

Conclusion: Is SEK a good investment?

Since Sweden has one of the strongest economies in the world, it is no wonder that the Swedish krona holds strong positions on the global market. Considering that the US Dollar is on the fence – the currency is under the risk of serious devaluation due to geopolitical turmoil – SEK has every chance to keep growing without barriers. That makes it a great potential investment in the long term. However, if you are searching for a currency pair to trade intraday, SEK/USD is not the best instrument.

FAQ

What is the forecast for the USD/SEK pair in 2024?

In 2024, SEK is expected to overcome its resistance level of 10.6 and reach 11.00 and higher. Generally, 2024 promises to be marked by growing strength of the currency. However, it is crucial to be on the lookout for market changes and sentiment, because the US Dollar can perform unpredictably.

What is the projection for SEK/USD?

In the coming years, SEK USD is expected to grow moderately, about 1.0 per year. Hence, by 2028, it may reach the 14.0 level. However, this is a very long term, and SEK may start losing its positions if the US Dollar gains traction.

Is the SEK getting stronger?

In recent years, SEK has been under pressure because of Sweden 's economic slowdown and the real estate crisis. However, since November 2023, the currency has been reviving. In contrast to other European central banks, the Riksbank announced that it’s ready for another hike, if necessary.

Is USD/SEK a good pair to trade?

In terms of intraday trading, USD/SEK is not the best choice, because this pair is not prone to considerable fluctuations. You can expect a change of several cents per day, but that is not enough to speculate on. Otherwise, you would need a large volume to operate with.

Is the US Dollar stronger than the Swedish krona?

At the moment of writing this article, SEK is slowly regaining its strong positions. By the end of 2023, the USD/SEK rate was around 10.4; in February 2024, it climbed to 10.5. Hence, the Swedish krona is getting stronger than the US Dollar, and there is no indication of a trend reversal.