What Is a Pip in Forex Trading?

Knowing what pips are in forex is a must for everyone who wants to trade, regardless of markets. Standing for "percentage in point," pips help users measure price movements of one currency relative to its counter currency in a pair. They are essential for assessing profits, losses, and general market dynamics. This detailed article describes how a pip works, explains the meaning in forex trading, and shows how traders utilize them to gauge pip movement.

Table of Contens

What Is a Pip?

How Do Pips Work?

Explanation of Pipettes

Calculating Pip Value

Pips, Spreads and Profitability

Pips in Extreme Conditions

Conclusion

FAQs

What Is a Pip?

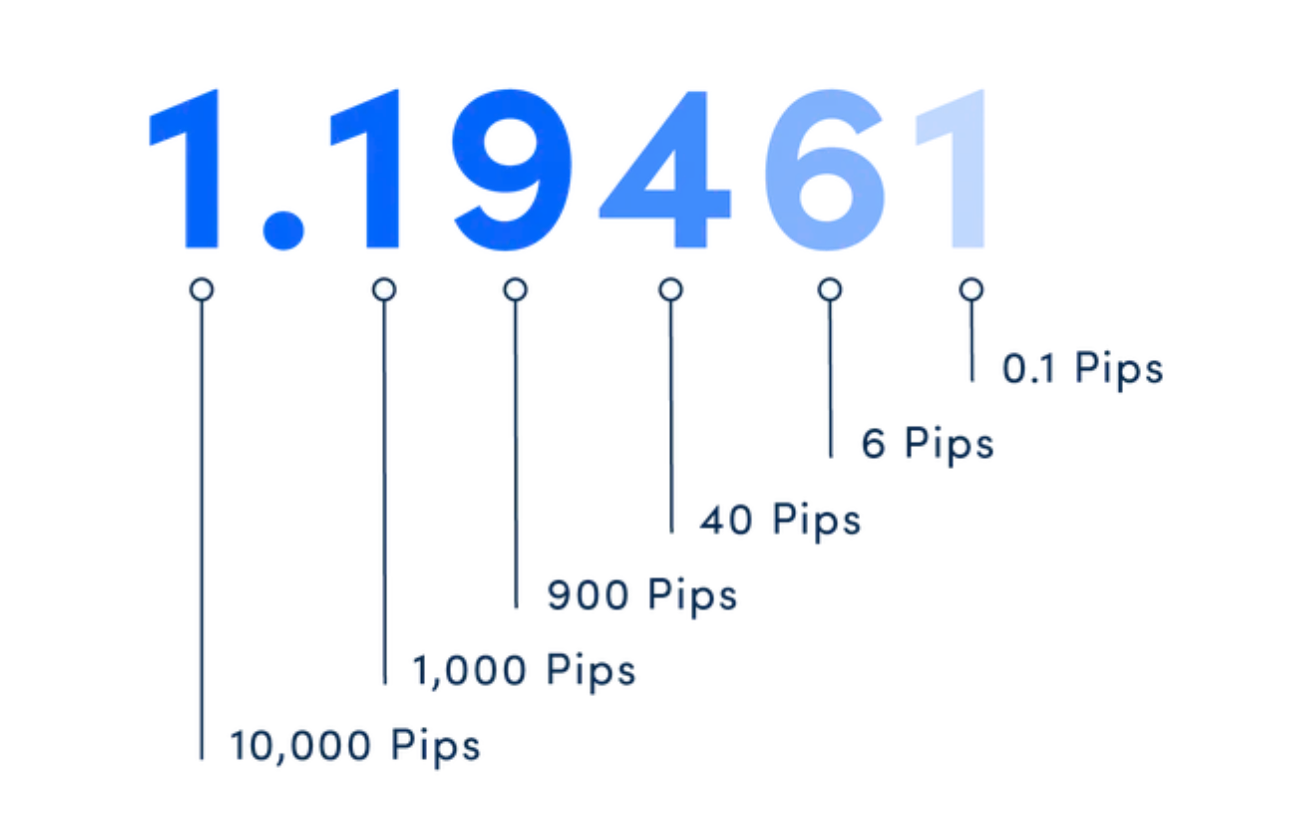

A pip is the smallest unit cost movement that an exchange rate can make. A pip is usually in the fourth decimal position (0.0001), which is one-hundredth of one percent (1/100 *.01) because the majority of currency pair prices have four decimal places. For instance, the USD/GBP pair rate can alter by as little as $0.0001, or one pip, as a complete unit.

The term "pips" in forex trading should not be mistaken for BPS (short for "basis points”). Basis points are units to measure interest rates: they are equivalent to 1/100th of 1%, or 0.01%. BPS can also be called ‘price interest point’ or ‘point or price interest’.

Here is some essential information about pips you should now:

-

Pip stands for ‘percentage in point’ and serves to express price fractions of currency pairings.

- A pip is 1/100 of a percent (1/100 *.01), so it is represented as 0.0001 to the fourth decimal point.

- For the majority of forex pairings, it is the lowest price change possible.

- A pair quote's bid-ask difference (spread) is commonly expressed in pips.

How Do Pips Work?

As we’ve mentioned, most currency pairs have four positions after their decimal places. However, smaller price increments also exist: they are called ‘pipettes’, and we will discuss them a bit later.

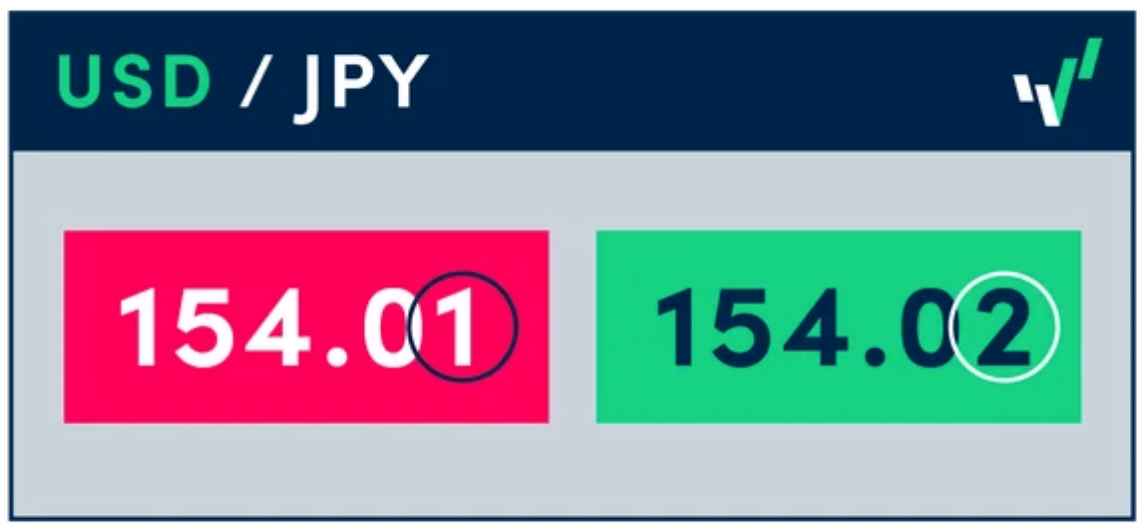

Japanese yen pairs are a rare exception from this rule since there are only two decimal places. In this pairing, a single pip change is the second number following the decimal point. For example, a shift in exchange rates from 154.01 to 154.02 in a yen pair counts as a single pip alteration.

Here is a table that explains how pips work in some currencies:

| Currency |

Number of pips |

| US dollar |

4 |

| Euro |

4 |

| Japanese yen |

2 |

Explanation of Pipettes

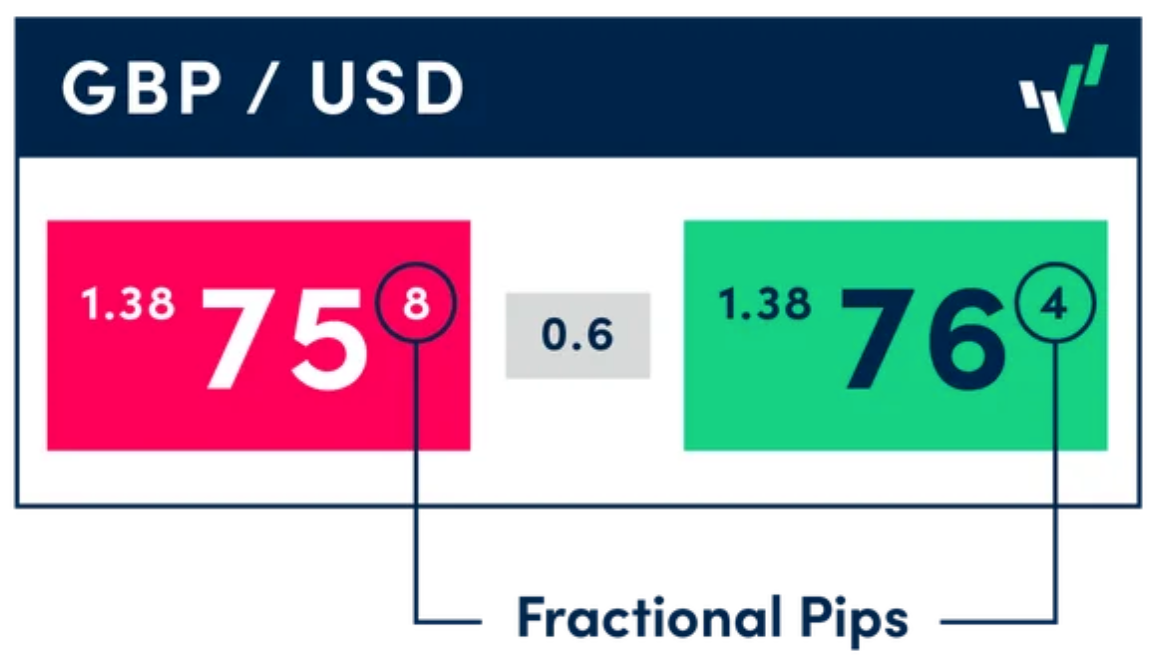

Fractional pips (smaller price fluctuations) are called "pipettes" – they equal 1/10 of a pip. The quotation panel shows pipettes in superscript format. Here is an illustration: in the GBP/USD pair, it is in the 5th decimal position:

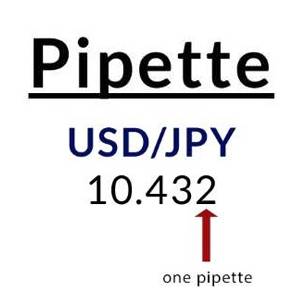

A pipette in yen pairs is in the 3rd decimal place:

Calculating Pip Value

To figure out the value of one pip, you need to multiply one pip (0.0001) by the lot size. While mini lots consist of 10,000 units of the base currency, standard lots have a 100,000 trade size.

Regardless of the currency pair, a single pip movement in a standard lot of 100k will be worth $10 (0.0001 x 100,000).

Pip value = 100,000 x 0.0001

Value of a pip - $10

In this case, every pip movement according to the trader's expectations generates them a $10 profit. Vice versa, every pip that moves against the trader’s plans results in a $10 loss.

Pro tip: The pip value for a single currency pair will always change slightly since their exchange rate keeps fluctuating.

Pips, Spreads and Profitability

A trader's profit or loss is determined by the movement of currency pair exchange rates. If the euro appreciates in value in relation to the US dollar, a trader who purchases EUR/USD will profit. For example, if a trader purchases the euro at 1.1743 and sells it at 1.1697, their loss is 46 pips.

Now imagine a trader selling the USD/JPY pair at 113.02. If they close their position at 112.08, they will lose four pips. If they close at 113.11, they will make a nine pip profit.

Profits and losses can mount up rapidly in large-volume transactions, even if the difference seems to be insignificant. For instance, a trader would profit by ¥500k on a $10 mln stake that closes at 113.07. That amounts to $4,422.03 (¥500,000 / 113.07) in US dollars.

Now, let’s explain the notion of spread and a few basic definitions in leverage trading. A ‘bid price’ is the quote at which you want to sell an asset, while an ‘ask price’ is the quote at which you want to buy an asset. Spread is the difference between the buy and sell prices in a transaction. When you trade with leverage, your profit and loss can be multiplied not only in whole units, but also in pips. So don’t forget to practice risk management.

Pips in Extreme Conditions

Currency devaluation and hyperinflation together have the potential to drive quotes uncontrollably high. Not only does this affect customers who handle tons of cash, but it may also complicate trading, so pips become meaningless.

Here is a real-life illustration: In 1923, the German Weimar Republic's currency fell from 4.2 marks per USD to 4.2 trillion marks per USD. In 2001, the Turkish lira hit a value of 1.6 mln per 1 US dollar, which was beyond the capacity of several trading platforms. The new exchange ratio was called the new Turkish lira, when authorities removed 6 zeros from it. The average currency rate (TKY/USD) as of March 2024 was 0.031 lira per USD.

Conclusion

Knowing the definition and specifics of pips is the basis of forex trading, no matter what currencies you work with. Even slight movements of several pips can make a difference in your profits or losses, especially if you apply leverage. By correctly calculating the number of pips between the ask price and the bid price, you can build a trading strategy and practice risk management at the same time.

FAQs

How do a pip and a pipette differ?

A pip is the smallest price alteration in the forex market, usually the fourth decimal position. A pipette is a fraction (1/10) of a pip, standing on the fifth decimal position. It allows for finer price quoting and tighter spreads in forex trade transactions.

How many pips a day do forex traders make?

Traders’ earnings are defined by a whole gamut of aspects, including their strategy, risk management measures, market trends, and deposit volume. If they use a scalping strategy, they can make a few dozen pips, while longer-term strategies are targeted at profiting by hundreds of pips or more. Whatever tactics you prefer, consistency and risk management are paramount.

What are ticks and points?

Ticks refer to the smallest possible price movement in the exchange rate of two currencies, typically one cent for stocks. Points, on the other hand, vary depending on the context: they can denote a larger price movement or index units, like the S&P 500 moving 10 points.

What is a pip in stocks?

Note that a pip in stocks might have a different meaning, because some traders use this word informally to refer to a minor price fluctuation (especially in penny stocks or highly volatile assets). Hence, “pip” can have slightly different meanings since there is no universally agreed-upon definition in the foreign exchange market.

What is 1 pip in forex?

One pip refers to the smallest price alteration in a trading pair rate. It is the fourth decimal place in the majority of forex pairs.

What does 50 pips mean?

Fifty pips in forex signifies a 50-unit alteration of a pair’s price. For instance, if CAD/USD moves from 1.2000 to 1.2050, it's a 50-pip increase. Traders often use pips to assess profits and losses, and set stop-loss orders.