What is CFD Trading - The Ultimate Guide

Contracts for Difference, or CFDs, are financial instruments that many investors have in their trading portfolios. They allow traders to gain exposure to various markets without actually owning the underlying assets.

However, CFDs are complex derivative products. It might be complicated for beginner traders to understand how to use them while limiting trading risks. So, we have prepared a detailed CFD trading guide, where we will answer such questions as “What is a CFD?”, “How do CFDs work?”, “What trading strategies should you use with CFDs?”, and much more.

Table of Contents

What is CFD Trading - The Ultimate Guide

Table of Contents

What are CFDs (Contracts for Difference)?

What is CFD Trading?

How CFDs Work with Examples

CFD Markets

How to start Trading CFDs

CFD Trading Examples

Profitable scenario

Loss scenario

CFD Trading Strategies for Beginners

Short & Long CFD Trading

Leverage in CFD Trading

Margin in CFD Trading

Hedging in CFD Trading

CFD Trading Strategies for Professionals

Rangebound (Range) Trading

Breakouts

Contrarian Investing

Trend Following

Rebate Trading

Scalping (aka Spread Trading)

Swing Trading

News Playing

CFD Benefits & Risks

CFD Benefits & Risks

CFD Risks

CFD Rules & Tips

CFD Trading vs. Others

CFDs vs. Share (Stock) Trading

CFDs vs. Spread Betting

CFD vs. Futures

CFDs vs. Options

CFD Trading FAQ

Can I trade CFDs without leverage?

How do I use CFDs for hedging?

What is the difference between CFDs and futures?

How Are CFDs Taxed?

What makes a CFD trader successful?

Is CFD trading legal?

What are CFDs (Contracts for Difference)?

A CFD, or Contract for Difference, is a type of financial derivative that allows traders to speculate on fluctuations in the values of underlying assets, such as stocks, forex pairs, commodities, indices, and more.

The process of CFD trading involves an agreement between the buyer and seller to exchange the difference between the current price of an underlying asset and its value at a fixed time in the future. If the market moves in a direction that’s favorable for traders, they will receive a profit. Conversely, if the asset price moves against traders’ expectations, they will face a loss.

The key feature of CFDs, in comparison with other derivatives, is that traders don’t need to own the underlying asset. They speculate on asset price movements. As a result, traders can benefit from both rising and falling market movements. It’s also important to note that CFDs give traders an opportunity to be exposed to larger financial markets, but, on the other hand, they come with significantly higher levels of risk.

What is CFD Trading?

CFD trading was initially introduced in the United Kingdom in the 1990s. Its main objective was to grant individual investors access to financial markets that were only available for large institutional investors. After its launch, the practice of CFD trading has significantly grown in global popularity, with a great number of brokerage firms now offering CFDs for a wide variety of asset classes.

As mentioned above, CFDs allow for speculating on asset price movements. When trading CFDs, a speculator agrees to exchange the difference in value between the opening and closing underlying asset price. It’s possible to open both long (buying) and short (selling) positions and receive profit if the market moves in the expected direction. Conversely, if the market moves against traders’ predictions, they suffer a loss.

CFD trading is usually accompanied by leverage. This tool allows investors to take large positions in the market with a relatively small amount of money. However, it’s crucial to understand that leveraged trading is complicated and implies much risk that can result in significant potential losses if the trader doesn’t have enough skills and experience using this instrument.

To get a better understanding of how to trade CFDs, you can also check out the following video:

What Are CFDs?

How CFDs Work with Examples

To find out how to trade CFDs, check out this example on the stock market.

Let’s say that a trader wants to invest in shares of an imaginary company called “BBB”. The current market price of this stock is $1,500 per share. The brokerage firm offers a leverage of 10:1, which means that the trader can control a position of $15,000.

The trader decides to buy 20 contracts of the “BBB” CFD, with each contract representing 10 shares. The total value of the position will be $300,000 ($1500 * 200 shares), but the trader only needs to deposit $30,000 as margin.

Positive case:

The trader holds the trade open for 2 weeks, and the “BBB'' stock value goes up to $1,700. He decides to close the position by selling the contracts, making a profit of $40,000 minus the broker commission (($1,700 - $1,500)* 200).

Negative case:

If the “BBB” share price drops in contrast to the trader’s forecast, and he decides to close the trade by selling the contracts at $1,400 per stock, the loss would make $20,000 plus the broker commission (($1,400 - $1,500)* 200).

As we can see, leverage can amplify not only profits but also losses. Thus, traders should manage their risk carefully and have a clear understanding of the margin requirements and the potential impact of price moves.

When trading CFDs, it’s important to consider some factors. Here are some of them:

- Spread. This is the difference between the buy and sell prices that brokers quote. For example, if a broker presents a 1% spread on a CFD for “BBB” shares and the current market price for this asset is $150, the buying cost would be $151, and the selling price would be $149.

- Broker commission. This is a fee charged by brokers to facilitate a trade. Different brokers may come with various commission regulations. Some of them charge fixed commissions per trade, while others give preference to a percentage of the total trade value.

- Deal size. This is the number of contracts traded in a CFD transaction. The size of a contract is usually determined based on the broker's margin requirements and the underlying asset.

- Duration. CFD trades can have various times of execution. This usually depends on the broker’s regulations and the trader’s preferences. Some trading platforms may offer CFDs that expire at a specific date and time, while others allow traders to retain positions for the time they want.

- Profit and Loss. It’s crucial to understand that both profit and loss incurred during a CFD trade are calculated based on the total position value. Therefore, traders can benefit from amplified profits, yet they should be aware of amplified potential losses as well.

CFD Markets

CFDs come with a wide range of financial markets for traders to participate in. The list includes:

- Indices

- Stocks

- Forex

- Commodities

- Cryptocurrencies

- And more

Opting for CFDs while trading these instruments allows traders to take advantage of both rising and falling markets, as well as gain larger exposure with significantly lower capital outlay.

How to start Trading CFDs

If you are a beginner trader who is planning to start trading with CFDs, here is a step-by-step guide to follow.

- Educate yourself. Remember that CFDs are complex trading instruments that come with high risk. Thus, it’s crucial to learn the basics before you commence your trading experience.

- Choose the market. As previously mentioned, CFDs can be traded on a wide range of financial markets, including stocks, commodities, currencies, and indices. Learn more about each instrument and choose the one that complies best with your trading experience, trading style, and risk tolerance.

- Choose a broker. CFDs are popular derivative instruments that are provided by many brokers and trading platforms. Opt for a reliable broker with a good reputation, such as Just2Trade. When making your choice, don’t forget to pay attention to the fees and commissions.

- Open a brokerage account. When trading CFDs, it’s necessary to open a brokerage account which will allow you to use leverage. This usually involves filling out an online application and providing identification documents.

- Go long/Go short. After you’ve decided which asset to trade, conduct a market analysis to find out potential opportunities. With CFDs, you can open a long (buy) position if you believe that the market will grow, or a short (sell) position if the market is going to fall, according to your research and forecast.

- Monitor your trade. Once your position is open, it’s crucial to constantly keep an eye on it to mitigate potential risks and adjust stop-loss orders.

- Close the position. You can close the trade or it can be closed automatically when it reaches the level of stop-loss or take-profit. If the position is profitable, the broker will pay you the difference. In contrast, if you face losses, you will have to compensate the difference to the broker.

CFD Trading Examples

Once you’ve decided to open a CFD trade, the most important thing is to choose a reputable broker and open a trading account. This requires traders to deposit some collateral funds into their accounts, which is called margin.

Let’s consider an example of a CFD trade with commodities. Say a trader selects gold as the underlying asset for his trade. When choosing the position size, the trader should take into account such factors as risk appetite and available capital to deposit the margin. In our example the trader decides to set the trade size at 10 CFDs of gold, with each CFD representing one ounce of gold.

According to the trader’s technical and fundamental analysis, the value of gold is going to increase in the near future. So, he opens a long position. At the current moment the price per ounce of gold is $1,990. To calculate the total position size, it’s also important to take into consideration the broker’s spread, which in this case, for example, will be $1,991. Thus, the total position size in our example will be:

Total position size = Price of gold with spread * Number of CFDs = $1991 * 10 = $19,910

It’s important to remember that CFDs are commonly traded with leverage. Thus, the trader will be required to deposit a percentage of the total position size as margin, say 5% ($995.5).

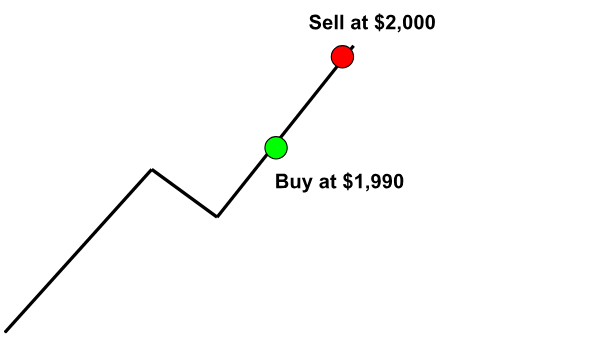

Profitable scenario

Say that a few days later there was an increased demand for gold in the market which caused its price to surge to $2,000 per ounce. So, the trader decides to close his position and take a profit. He places a sell order for 10 CFDs of gold at the current market price of $2,000 per ounce.

Here is the formula to calculate the returns:

Therefore, the profit of the trade in our example will be calculated as follows:

Profit = (Sell asset price - Buy asset price) * Number of CFDs

Profit = ($2,000 - $1,991) * 10 = $90 (minus broker’s fees and commissions)

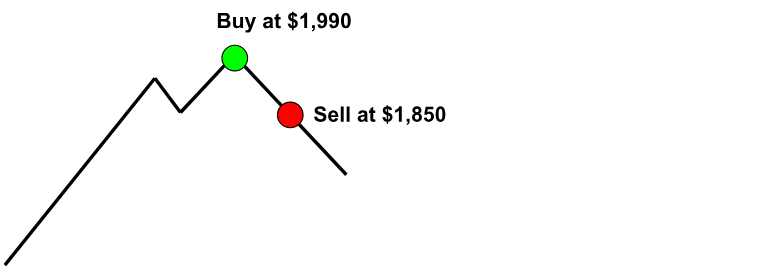

Loss scenario

Say that a few days later the gold market enters a downtrend in contrast to the trader’s forecast and the gold price drops to $1,850. To limit his losses, the trader decides to close his position. He places a sell order for 10 CFDs of gold at the current market price of $1,850 per ounce.

The loss is calculated with the same formula as the profit. In this case, it will be:

Loss = ($1,850 - $1,991) * 10 = $-1,410

As we can see, the amount of loss ($1,410) exceeds the amount of initial margin ($995.5). This means that the trader will be subject to a margin call. If he doesn’t deposit more capital to cover the margin call, the broker will have the authority to liquidate the investor's positions to compensate for the deficit.

It’s crucial to underline that CFD trading implies high risks and may not be a good choice for newbies. The market can be very volatile and result not only in amplified profits but also losses. Therefore, when using this instrument, it’s necessary to have a robust risk management and trading plan.

CFD Trading Strategies for Beginners

CFDs offer the potential for increased returns. However, they also come with a higher degree of risk. To minimize your risks and increase your chances of success, let’s have a look at some common CFD trading strategies.

Short & Long CFD Trading

When trading CFDs, traders speculate on the asset price movement. They can open a long (buy) trade if they consider that the asset price will increase in value, or open a short (sell) trade if they believe it will decrease in value. The profit in CFD trading is the difference between the buy and sell trade price. This means that if the trader’s predictions are correct, they will take a profit. However, if the market moves in the opposite direction, they will face a loss.

Leverage in CFD Trading

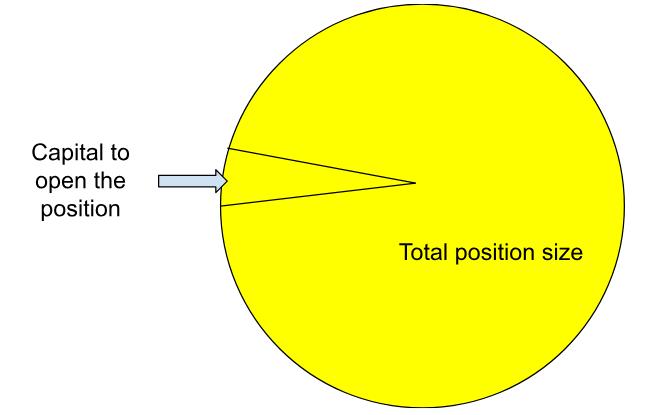

Leverage is a helpful financial tool that allows traders to get a larger exposure to the market with a significantly smaller initial investment. To put it more simply, the trader needs to outlay only a small percentage of the total position value, and the rest of the funds are provided by the broker.

The amount of leverage can vary significantly, depending on the financial instrument, broker regulations, and trader’s risk tolerance. In general, brokers offer leverage ratios ranging from 2:1 to 500:1. This means that for every dollar of capital a trader invests, they can control a position of $2 to $500.

However, while leverage can amplify potential profits, it can also amplify potential losses. Therefore, it's important for traders to understand the risks of leverage and use it responsibly to manage their trades.

Margin in CFD Trading

The concept of margin is closely interconnected with leverage. It is the collateral that a trader needs to deposit with a broker to open and maintain a leveraged position in the market. Just as with leverage, the amount of margin required varies depending on the underlying asset, the size of the position, etc.

There are mainly two types of margin:

- Initial margin. This is the amount of capital a trader needs to provide to a broker to open a trade.

- Maintenance Margin. This is the minimum amount of capital that a trader needs to maintain in his trading account to keep the position open. If the account balance decreases below this level, a trader will receive a margin call, requiring him to add extra funds to keep the position open.

Hedging in CFD Trading

The technique of hedging is often used by traders to reduce potential losses. This method involves opening a position in the opposite direction of an already existing position for the same asset.

For instance, let's assume that you have opened a long position for a CFD with Apple Inc., at the cost of $150 per share. To hedge your position, you could establish a short position for the same CFD, with Apple Inc., at the cost of $140 per share. This way, if the market starts to drop, the profit on the short position would offset the losses incurred on the long position.

CFD Trading Strategies for Professionals

CFD trading is complicated and implies much risk. Thus, both beginner and experienced traders looking to gain potential profits need to have a well-planned and disciplined trading strategy. Let’s have a closer look at some of them.

Rangebound (Range) Trading

Rangebound trading is a CFD technique that implies generating profit from the price fluctuations of an asset within a predefined range. To implement this strategy, a trader defines the upper and the lower boundaries of the range and then conducts a buying trade when the price is in proximity to the bottom, and executes a selling trade when it is near the top.

A range strategy is commonly more effective when the asset price experiences low volatility and is trading within a specific range. Moreover, to get a better understanding of the market, traders are advised to use technical analysis tools and support and resistance levels.

Breakouts

The breakout strategy is a popular approach used by CFD traders to capture potential profit opportunities in volatile markets. With this strategy, traders first define support and resistance levels, and then look for the asset price to break either of them. Once that happens, traders take positions in the direction of the breakout.

A breakout trading strategy is a better fit for traders who are comfortable with taking risks, have a good understanding of technical analysis, can identify key support and resistance levels, and can accurately interpret market trends.

Contrarian Investing

As is evident from the name, contrarian investing implies going against the main market trend. Traders who use this trading technique consider that when the majority of market participants are buying or selling, the asset is likely to be overpriced or underpriced. Contrarian investors try to identify such market situations and take long positions when the market is in a downtrend and short positions when it’s on the rise.

This strategy can be potentially more profitable due to the quick price moves in case of a change in the market sentiment. However, it implies more risks as it involves taking positions against the prevailing trend.

Trend Following

Trend following is one of the most popular strategies used with CFDs. It involves analyzing the market with various technical analysis indicators and identifying the prevailing trend. When the trend is defined, the trader opens a position in the direction of the trend.

The most common technical analysis tools used in trend following include but are not limited to:

- Moving Averages

- Relative Strength Index (RSI)

- Fibonacci retracements

Bollinger bands

And more.

Rebate Trading

Rebate trading implies using the commissions paid on CFD trades to offset losses incurred on the same trades. In this strategy, the trader opens a CFD position and pays the broker a commission for executing it. If the trader faces a loss, the broker compensates it by offering the trader a rebate that is proportional to a part of the commission paid. The trader can then use this rebate to counterbalance some or all of the losses sustained on the position.

Rebate trading can be a useful instrument to offset losses and gain some extra profits. However, it's crucial to remember that rebates are not always available or guaranteed. Moreover, traders who rely too heavily on this technique can find themselves in over-trading or other risky conditions.

Scalping (aka Spread Trading)

Spread trading is a short-term technique that involves constantly buying one asset and simultaneously selling the other one. In this strategy, traders are not trying to predict the direction of the market trend, but gain potential profits from the difference in price movements between two related assets. Scalping is most commonly used in the foreign exchange (Forex) market.

Swing Trading

Swing trading is a short- to middle-term trading strategy which implies taking advantage of market swings. A swing is a short-term price fluctuation within a longer market trend. Swing traders try to enter the market at the beginning of a swing, hold the position as the asset price moves in their favor, and close the position at the end of the swing.

In contrast to scalping, which requires constant attention and engagement, swing trading is slightly less time-consuming. Yet, it still comes with high potential risks of losing much capital, especially without enough knowledge and experience.

News Playing

News plays an important role in the development of financial markets. They can cause sharp price declines or inclines, bringing traders higher potential returns or increased losses. Professionals often keep an eye on economic and political news events, and take positions based on the anticipated market reactions.

CFD Benefits & Risks

Just as with any financial instrument, CFDs come with pros and cons. Let’s have a closer look at the most important ones.

CFD Benefits

-

Larger market exposure. The high leverage used in CFD trades allows for opening larger positions without the need to cover the total position size. Instead, traders only need to provide a small initial margin.

- Short-selling opportunities. With CFDs, traders can take advantage of both rising and falling markets, meaning that they can open both long and short positions.

- Hedging. CFDs can be used to offset against potential losses in other positions, thereby reducing overall portfolio risk.

- Accessibility. CFDs allow traders to enter a wide variety of financial markets, including Forex, commodities, indices, stocks, and more.

CFD Risks

- Leverage. It’s a double-edged sword. As mentioned above, leverage can help traders to open larger positions and gain potentially more profits. However, on the other hand, it involves more risks and can result in amplified losses.

- Market volatility. CFDs are highly sensitive to market volatility, which can lead to sudden and large price movements, resulting in increased potential losses.

- Complexity. CFDs are complicated products that require a good understanding of the underlying markets. Lack of knowledge and experience can result in high potential losses.

- Counterparty risk. CFDs lack regulation, and therefore require particular caution when selecting the broker. It’s crucial to make sure your counterparty is reliable and reputable.

CFD Rules & Tips

There is no perfect formula to gain profits and limit losses in CFD trading. Nevertheless, we have gathered here the most valuable tips and tricks to help you manage your trades.

-

Keep educating yourself. It's important to understand the basics of CFD trading before diving into it. You should know what CFDs are, how they work, and what the associated risks are.

- Develop a robust risk management plan. When working on such a plan, remember not to invest more than you can afford. It’s usually advised not to risk more than 1-2% of your trading account on any single trade.

- Set stop-loss orders. Stop-losses are useful risk management tools that close your trades automatically when the asset price reaches a certain level.

- Opt for the right broker. Choose a reputable brokerage firm with a good and long reputation.

- Use demo accounts. The majority of brokers let traders use demo accounts where the latter can test their trading strategies without risking their capital.

- Keep your emotions under control. Emotions can cause you to make spontaneous and irrational decisions that can incur potential losses. Thus, it's essential to keep your emotions in check and stick to your trading plan.

- Keep an eye on the news. Remember that any type of news or event can have an impact on the financial markets.

- Use technical analysis. Technical analysis charts and indicators can help you identify potential market opportunities, offset trading risks, and make more informed trading decisions.

- Analyze your mistakes. It’s normal to make mistakes. The key is to learn from your mistakes and use them to improve your trading strategy in the future.

CFD Trading vs. Others

To understand the difference between CFD and other trading instruments, let’s explore their definitions and outline their key features.

CFDs vs. Share (Stock) Trading

As previously mentioned, CFDs are derivative products that allow traders to speculate on price movements without actually owning the underlying asset. Stock trading, in contrast, involves buying and selling shares of companies.

Another core feature that differentiates CFDs and stocks is the possible amount of leverage. In contrast to stocks, which are usually traded with or without small levels of leverage, Contracts for Difference come with a high leverage percentage, which allows traders to open larger trades than they could afford with their capital only.

CFDs vs. Spread Betting

Neither CFDs nor spread trading require ownership of the underlying asset. Instead, traders speculate on the changes in the market price. However, these are different financial products.

While CFDs are leveraged contracts that pay off according to the underlying asset's price movement, spread betting involves placing bets on the price movements of an underlying asset without actually owning it. Another key difference is taxes. For example, in the UK, spread betting is considered gambling and is tax-free. CFDs, on the other hand, are subject to capital gains tax.

CFD vs. Futures

CFDs and futures come with different ways of trading. While CFDs are considered OTC products, futures are traded on exchanges. What’s more, CFDs usually offer lower margin requirements and are considered more flexible in terms of contract size and expiration dates, allowing traders to customize their positions more easily. Futures, in contrast, are standardized and have specific expiration dates and contract sizes.

CFDs vs. Options

The key difference between CFDs and options lies in the nature of these two contracts. CFDs are agreements between two parties to exchange the difference in price of an underlying asset, typically a stock, commodity, or currency. In contrast, options are financial instruments that give traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and time.

While both CFD and options trading offer traders the opportunity to profit from both rising and falling markets, they carry different risks and benefits.

CFD Trading FAQ

Can I trade CFDs without leverage?

How to trade CFD? It’s possible to trade them without leverage. However, most commonly it’s not recommended and not allowed by many brokers. Leverage is a helpful trading tool that allows traders to increase their exposure to the market. Still, it comes with high risks and can amplify not only potential profits but also losses.

How do I use CFDs for hedging?

When hedging with CFDs, traders need to open a position in a financial asset that is negatively correlated to an existing asset in their portfolio. It's important to note that while hedging can help to reduce risk in a portfolio, it may also limit potential gains.

What is the difference between CFDs and futures?

Comparing CFDs and futures, CFDs are more flexible in terms of contract size, whereas futures typically have standardized contract sizes and expiration dates. CFDs usually have lower transaction costs and may offer greater leverage, but they may also be subject to greater risk due to the possibility of margin calls.

How Are CFDs Taxed?

Tax regulation of CFDs can be different depending on the country you are trading and your personal circumstances. In many jurisdictions, CFDs are subject to the capital gain tax. Still, they are often free from stamp duty.

What makes a CFD trader successful?

A CFD is a complex derivative that requires skills and experience. To become a successful CFD trader, it’s crucial to have a clear understanding of how this instrument works, know how to implement and analyze technical analysis indicators, and develop a robust risk management and trading strategy.

Is CFD trading legal?

CFDs are legal in most countries. However, regulations may vary significantly depending on the country. In the US, CFD trading is illegal since CFDs are considered as Over-The-Counter (OTC) products.