What Is a Swap in Forex?

A swap is an important instrument in Forex trading, especially among traders who hold their positions for longer periods. It refers to the interest rate that a trader either pays or receives at the end of the trading day. In this article, we will have a closer look at the meaning of swap in Forex trading, explore the ways to calculate it, and provide examples of how it works with Forex currency pairs.

Table of Contents

What are swaps and how are they calculated?

How to calculate a swap in Forex

FX Swaps and Cross-Currency Swaps

FX How a Currency Swap Works - FX Swap Examples

Can I make money from a swap in Forex trading?

What is the swap fee in Forex for Islamic accounts?

Conclusion

Forex Swap FAQ

What are swaps and how are they calculated?

A foreign exchange swap is an interest rate that is implemented to balance the difference in interest rates between the two currencies used in trading. It can be either paid or charged to a trader in case a currency position is held beyond one trading day.

To get a better understanding of what an FX swap is, let’s explore the key terms and components of the Forex market.

Firstly, it’s important to define the interest rate. It is a specific rate at which the central bank of a country lends money to other banks. It is determined by the country-issuer and may change over the course of a year. Secondly, it’s necessary to remember that on the Forex market, traders operate with pairs, each of which consists of two сurrencies:

- base (or deposit) currency

- quoted (or counter) currency

The base currency belongs to the trader and is used by the exchange or trading platform. Thus, the latter needs to pay a certain percentage to the trader for using it. In contrast, the quoted currency is owned by a bank and borrowed by traders on a daily basis. Thus, the latter need to pay a certain percentage for using it.

A swap in Forex can be of two kinds: positive and negative.

- A positive swap is earned when a trader has a long buying position in a foreign currency that has a higher interest rate than the one that they are shorting.

- A negative swap is paid when a trader has a short position in a currency that has a higher interest rate than the one that they are selling.

How to calculate a swap in Forex

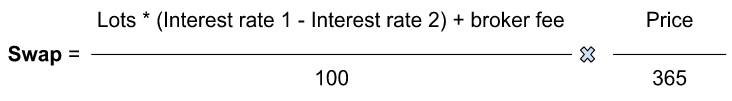

How is a swap calculated in Forex? Here is the formula that traders can use to calculate swap charges in Forex.

Let’s see the elements of the formula:

- Lot represents the lot size.

- Interest rate 1 stands for the interest of the base currency.

- Interest rate 2 stands for the interest of the quoted currency.

- Broker fee is the commission paid to the broker (markup).

- Price represents the exchange rate of the currency pair.

- 365 is the number of days in a year.

Let’s consider an example of a swap calculation with the EUR/USD currency pair when having a long position. Here are the variables of the formula:

- EUR has an interest rate of 3.5%.

- USD has an interest rate of 5% (which is higher than the base currency).

- 1 lot is 100,000 EUR.

- Broker fee is 0.25%.

- Exchange rate (price) - 1.1

The calculation will look as follows:

Swap = (100,000*((3.5%-5%)-0.25%)/100)*1.1/365 = - 5.25

As a result, we got a negative swap of -5.25, which means that for each day that this trade is held open, the investor account will be charged 5.25 USD as interest.

FX Swaps and Cross-Currency Swaps

In this section, let’s explore three main types of swaps used in the financial world.

Forex swap

An FX swap is a special agreement between two parties that exchange their currencies for a particular timeframe, and then re-exchange them at a later date. This operation is used as a hedging tool against potential movements in the currency exchange rates. Forex swaps are commonly used among market participants who are highly exposed to currency fluctuation risks, such as banks, large companies, institutional investors, etc. By using swaps, they can ensure they will receive a fixed amount of currency at a specific date in the future.

Cross-currency swap

A cross-currency swap is a type of agreement between two parties that exchange not only currencies but also interest payments. Note that each party uses a different currency. The core idea of this type of swap is to mitigate risks associated with changes in currency exchange rates and interest rates. Cross-currency swaps are usually used by multinational corporations and financial institutions to offset potential losses resulting from fluctuations in currency rates. For instance, if a company has revenue streams in one currency and debt obligations in another, a cross-currency swap can be used to hedge against adverse movements in exchange rates.

Currency interest rate swap on Forex

A currency interest rate swap on Forex is an agreement between two parties that allows for exchanging cash flows based on two different currencies, with each cash flow based on a different interest rate. This type of swap commonly implies exchanging fixed-rate interest payments in one currency for floating-rate interest payments in another currency. It means that the parties agree on the amount, the currencies involved, the fixed and floating interest rates, and the dates when the interest payments will be made. At a predetermined date, the parties exchange the cash flows based on the agreed terms.

How a Currency Swap Works - FX Swap Examples

As previously mentioned, a foreign exchange swap involves two parties that agree to exchange cash flows in different currencies at an agreed-upon rate and for an agreed-upon period of time. In Forex trading, swaps are usually used to hedge against currency fluctuation risks.

Calculating the swap fees on a short position

We have already explained the formula for calculating a Forex swap fee. Moreover, traders can also use various FX swap calculators, which are often provided by trading platforms for convenience.

In this example, let’s calculate the swap for the USD/CAD pair assuming that a trader has a short position.

Let’s say that:

- The USD interest rate is 5%;The CAD interest rate is 4.5%

- The markup is 0.25%

- The exchange rate is 1.35

Knowing the variables, we can calculate the FX swap for this position.

Swap (short position) = (100,000*((5%-4.5%) + 0.25%)/100)*1.35/365 = 2.7

Swap on a long position

In this example, let’s calculate the FX swap for the GBP/AUD pair, assuming that the trader has a long position. The variables for calculation will be the following:

- The GBP interest rate is 5%.

- The AUD interest rate is 3.6%.

- The markup is 0.25%.

- The exchange rate is 1.86.

The formula for calculating the swap will be:

Swap (long position) = (100,000*((5%-3.6%) + 0.25%)/100)*1.86/365 = 8.25

Can I make money from a swap in Forex trading?

There are two possible scenarios with FX swaps: you may either receive or pay a swap based on the interest differential between the currencies. If the currency you hold has a higher interest rate than the currency you are trading against, you will earn a positive swap. Conversely, if the interest differential favors the other currency, you will have to pay a negative swap.

Swaps can be a potential source of additional income for Forex traders. However, it's important to understand that the amount earned or paid on a swap is significantly smaller compared to the overall potential profits or losses of a trade. Moreover, traders should remember that swap rates can fluctuate over time, thus affecting the overall profitability of a position.

Carry Trade

A carry trade, a well-known strategy in the foreign exchange market, involves borrowing a currency with a low yield and investing in a high-yield one to make a profit from the difference in interest rates. By implementing swaps in a carry trade, investors can boost their returns and amplify their potential profits. To do that, they should select currency pairs with a high interest rate differential and a positive swap rate. However, it’s also important to regularly monitor the swap rates and adjust positions to limit potential risks.

Swap and Fly

Swap and fly is another trading strategy that allows trader to increase their potential profits by taking advantage of the difference in the interest rates between the base and the quote currencies. It implies that a trader will go long on a currency with a higher interest rate and go short on a currency with a lower interest rate.

Let’s consider an example of swap and fly with USD/CAD pair. The current interest rate on USD is 5%, while the interest rate on CAD is 4.5%. The trader would go long on USD/CAD to earn the interest rate differential. If the trader buys 1 lot of this currency pair, they would earn USD interest overnight while paying CAD interest overnight. Since the interest earned on USD is higher than that of CAD, the trader can earn a positive swap rate.

Currency Futures Strategy

Swaps in currency futures are used to secure current interest rates for a specified period. When a speculator takes a buying position in a futures contract, a swap will help them to lock the interest at a specific level, this way protecting traders against the possible future hikes. On the other hand, if a trader opens a short position in a currency futures contract swaps will help them to shield the position against the potential decline in interest rates.

What is the swap fee in Forex for Islamic accounts?

A swap on Forex is an interest fee charged on overnight positions in Forex trading. However, there is a type of account that comes without this fee. It’s called an Islamic account. According to Islamic law, Muslims are prohibited from charging or paying any interest. Therefore, brokers introduced this swap-free option that, nowadays, can be used by any trader. Yet, it should be noted that, instead, these accounts may charge other types of fees or commissions to compensate for the swap fee.

Conclusion

A swap in Forex means the interest fee that is charged or earned on open positions held overnight. It can be positive or negative, depending on the interest rate differential between the currencies being traded. Swap charges in Forex can be used by traders along with various trading strategies, such as carry trading, swap and fly, futures trading, and more.

Traders who are willing to implement Forex swap rates should remember that this instrument can bring potential profits. However, just as anything in trading, it comes with particular risks that should be examined and taken into account when developing a trading and risk management plan.

Forex Swap FAQ

What is the meaning of swap in Forex trading?

A swap in trading refers to the process of buying and selling the same amount of a currency simultaneously at a forward exchange rate while the transaction is settled at a predetermined future date. The purpose this instrument is to hedge investors against potential currency fluctuations and to bring potential profits through the difference in interest rates between the base and quoted currencies.

How is rollover interest calculated?

Rollover interest in Forex is calculated based on the difference between the interest rates of the two traded currencies as well as the amount of the trade position held overnight.

What is a carry trade?

A carry trade is a trading strategy in which a trader borrows money in a currency with low interest rates and invests it in a currency with higher interest rates. Carry traders often implement swaps to increase their potential income.

What is tom next?

Tom next is a metric used to estimate the expense or earnings of keeping a Forex position active overnight. In the realm of Forex trading, it determines how much income or costs a trader receives for holding a position open beyond the current trading day.