Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

As we approach the new year, investors will be evaluating the best stocks to consider, with the technology sector certainly of interest.

Semiconductor stocks will be targeted in particular, thanks to their reach in configuring artificial intelligence. That said, here are three of the top semiconductor stocks to invest in going into 2025.

One company leveraging the demand for AI chips of late is Broadcom AVGO which is a key supplier to Apple AAPL. Designing custom AI accelerators for data centers, Broadcom recently announced it secured two hyper-scale data center customers which are rumored to be Alphabet GOOGL and Meta Platforms META or the likes of Amazon AMZN and Microsoft MSFT.

These strategic partnerships have made Broadcom’s growth narrative very appealing with the company thought to be the second-largest AI semiconductor supplier.

We’ll pivot to the largest AI chipmaker Nvidia NVDA. While Nvidia’s Blackwell series AI chips have faced some challenges with overheating they are considered the highest-performing AI chips on the market.

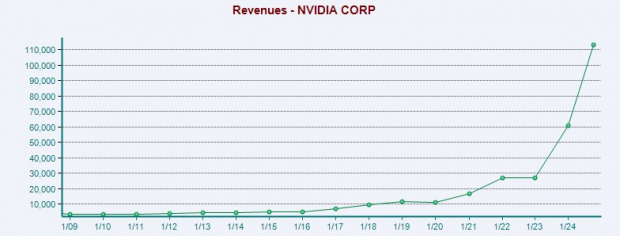

Furthermore, Nvidia’s H100 and H200 series chips have sparked considerable growth with the company’s total sales projected at $129.02 billion in its current fiscal 2025. This is an increase of over 1000% from the start of the current decade with 2020 sales at $10.91 billion.

Image Source: Zacks Investment Research

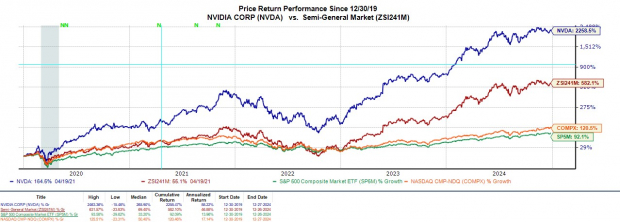

Astonishingly, the price performance of NVDA has more than doubled the percentage growth the company has seen on its top line making it noteworthy that FY26 sales are projected to increase another 48% to $191.84 billion.

Image Source: Zacks Investment Research

Last but not least is Taiwan Semiconductor TSM which is also a key supplier for Apple as the world’s largest provider of integrated circuit foundries (ICs). While Taiwan Semiconductor doesn’t manufacture AI chips directly, it provides the foundries that help other companies produce AI chips including Nvidia.

What may appeal to investors is that TSM has the cheapest P/E valuation on the list at 29.2X forward earnings. Even better, Taiwan Semiconductor is expected to post double-digit top and bottom-line growth this year and in FY25.

Image Source: Zacks Investment Research

Bottom Line

With theglobal marketfor artificial intelligence presumed to be worth trillions in the coming years, these top semiconductor stocks should be lucrative investments going into 2025. To that point, Broadcom, Nvidia, and Taiwan Semiconductor should continue to encompass this appealing growth narrative.

Energy is the backbone of our economy. It’s a multi-trillion dollar industry that has created some of the world’s largest and most profitable companies.

Now state-of-the-art technology is paving the way for clean energy sources to overtake “old-fashioned” fossil fuels. Trillions of dollars are already pouring into clean energy initiatives, from solar power to hydrogen fuel cells.

Emerging leaders from this space could be some of the most exciting stocks in your portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks free today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.